17 years helping Canadian businesses

choose better software

What Is Mortgage Automator?

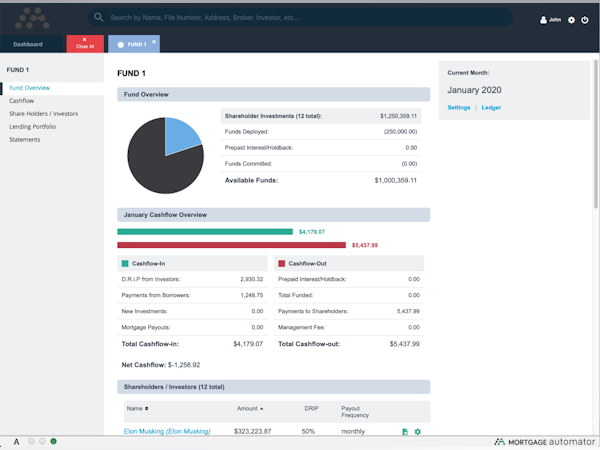

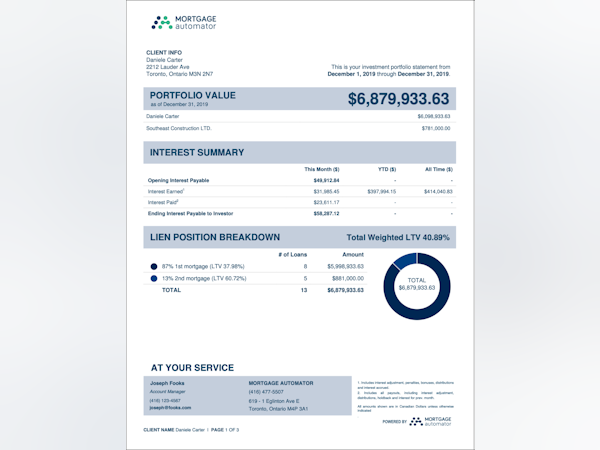

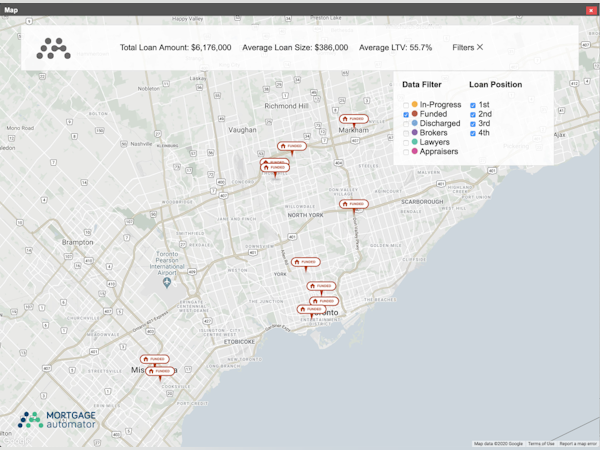

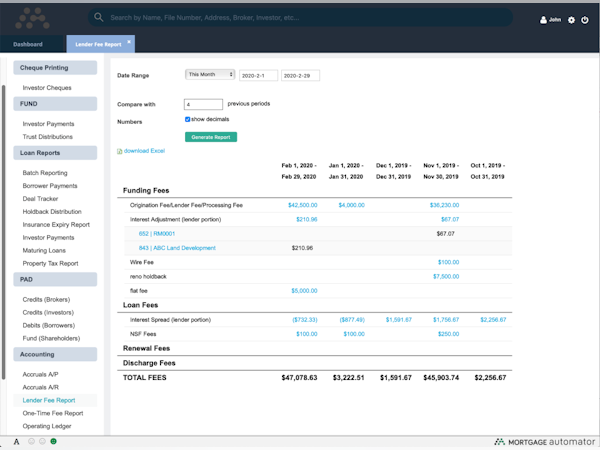

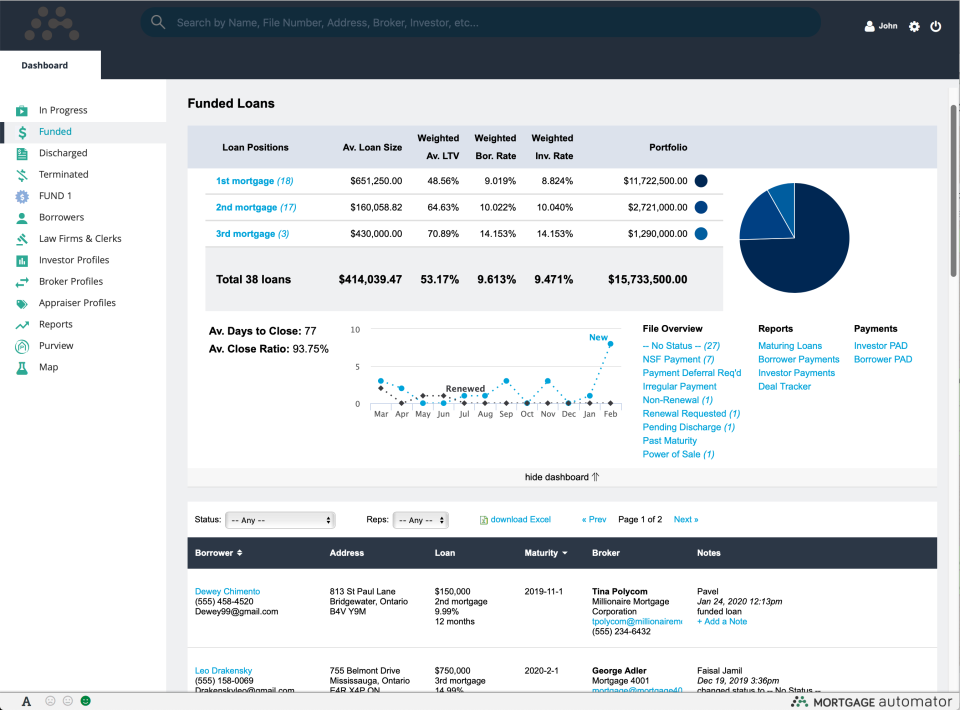

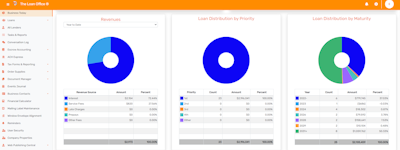

Mortgage Automator is the most comprehensive end-to-end loan origination & servicing software for North American private/hard money lenders. Perfect for residential (rehab/fix & flips, purchase, refinance), commercial, and construction lending, the platform can auto-generate your documents, compliance forms, ACH/PAD payments, monthly statements, and much more. We offer the best training and customer support in the industry so you can automate your processes and focus on growth.

Who Uses Mortgage Automator?

Private lenders, hard money lenders of all sizes: individual/family funds, administrators, GP LPs, mutual fund trusts, MICs, private equity funds.

Not sure about Mortgage Automator?

Compare with a popular alternative

Mortgage Automator

Reviews of Mortgage Automator

Alternatives Considered:

Mortgage Automator is the backbone of my lending business.

Comments: overall, Mortgage Automator has become a critical and useful tool in our business. if I had to lose email, or Mortgage Automator, i'd flip a coin. use both everyday

Pros:

Mortgage Automator has evolved over the years to grow with my company. We switched to Mortgage Automator to use the document generation and payment features, now we also use it for report building, automated communications with external clients, (SMS and Email) fund accounting, submission ingestion and internal to-do lists as files progress through the lifecycle.

Cons:

Some of our suggestions take weeks or months to be implemented into new versions of the system.

Mortgage Automator allowed us to go from being manual to fully automated for mortgage lending and administration

Comments: The overall experience has been positive as the system has many good features, is continuously being updated with new features and is user friendly.

Pros:

Mortgage Automator is an end-to-end solution for mortgage underwriting, issuing commitment letters, ongoing administration to discharge. The system is continuously updated with new features. Many of the features are customizable such as the ability to add custom fields and documents. The system has built in reports and a Report Builder feature which is very useful in helping to manage the portfolio. The system is used on a daily basis with mortgage applications downloaded directly into the system. The system is well suited for our business model. From a cost benefit perspective Mortgage Automator is a great value proposition.

Cons:

Online user documentation does not have enough depth and instruction in terms of how to use the various features of the system. Support is generally good however can be lacking in responses. Returning to ongoing webinars would be very useful. Custom documents can be created however the feature is not user friendly.

Solid service

Pros:

Easy to use and flexible in adding additional features

Cons:

Hard to identify certain features that might be beneficial

Alternatives Considered:

Mortgage Automator Review

Comments: Excellent onboarding experience. Customer service is outstanding.

Pros:

Easy to use, intuitive and the onboarding is exceptional!

Cons:

A bit pricey. Other than that, the system is great.

Alternatives Considered:

Mortgage Automator Experience

Comments: Overall, Mortgage Automator is a game-changer for mortgage lending, combining efficiency, reliability, and ease of use to revolutionize the industry!

Pros:

The Mortgage Automator software stands out for its user-friendly interface and comprehensive features. It's intuitive design makes navigating complex mortgage processes a breeze, even for users with limited technical expertise. Additionally, the robust reporting capabilities provide valuable insights into loan performance and operational efficiency, empowering lenders to make informed decisions.

Cons:

I wish this platform was available on the mortgage brokering side.... I LOVE IT SO MUCH!

Alternatives Considered:

The best thing that happened to our company.

Comments: Mortgage Automator has made it easy for us to grow our business. Without it, we'd be stuck in the spreadsheet era.

Pros:

We now have the ability to procude loan documents at a speed that would have been unbelievable a few years ago. All our documents and deal flow are seamless from receipt of an application to funding and beyond.

Cons:

I can't think of anything negative to say about Mortgage Automator. They keep refining it every month.

Alternatives Considered:

Great improvement from our previous system

Comments: The Mortgage Automator team was great throughout the entire transition. From on boarding to training and ongoing support. They are always there when we need them.

Pros:

Easy to use and has reduced time to underwrite files. The system is slick and performs all of the tasks we had hoped it would.

Cons:

We haven't run into any issues with the system as of yet.

MA review of loan processes

Comments: excellent relations with their top team who obviously know what they are doing and quick to respond to any issues that may arise.

Pros:

Ability to identify loan origination breakdowns, i.e. 1st, 2nds, blankets, etc. as well as handling of individual investors per deal.

Cons:

difficulty in dealing with annual statements and amortisation calculations for administration purposes. I like simplicity for the reader to understand what they are looking at, however i find i have to manually modify payout statements that are overly detailed rather than consolidated.

Software designed for Private Lending Originations & Mortgage Administration

Comments: Experience has been great. Very user friendly and ability to customize platform to our needs.

Pros:

Great customer service; ease of use and clean interface;

Cons:

lacking integration with Quickbooks however MA is regularly coming out with enhancements which hopefully provides for such integration.

Great Product

Comments: Our experience was great overall. I have nothing but great things to say about the Mortgage Automator team.

Pros:

I thought it was an all encompassing software for any lender. I was able to run my entire business with one software with the exception of marketing.

Cons:

It took a little while to get setup but that is because the software is so robust.

Alternatives Considered:

Constantly Improving

Pros:

I love how responsive customer support is. They have technical experts ready to answer all of my questions all day every day. I can chat or email with anyone from the CS team and they get back to me promptly with solutions to all of my problems

Cons:

The borrower application, while customizable is the clunkiest feature of the product. I've had a lot of problems with it, but the team does recognize this is an issue and is working to make improvements on it.

Mortgage Automator Response

3 years ago

Thank you for a great review, Nick! The borrower application is currently in beta and a new version is going to be released shortly.

The BEST way to automate your private lending business

Comments: The guys are amazing to work with! Quick service, friendly, and always willing to lend a hand to help!

Pros:

I love love LOVE this program. It has made my tracking headache free and comes with every option I need. The best part? Every time I think of a new option I might need, the developers at MA are somehow ALREADY ON IT! Can you say innovative? Would recommend to anyone who runs a MIC/ Private Mortgage company

Cons:

The only downfall I can see is the price. However that being said, we feel it is worth every penny. It does come in higher than other software however it takes the headache away from funding deals, issuing documents, and keeping track of funds!

Mortgage Automator Response

5 years ago

Thank you Jordan, we appreciate your kind words so much! We love working with you and will keep on eliminating those headaches for you!

Mortgage Automator has helped us streamline and improve efficiency across the organization

Pros:

Mortgage Automator is very user friendly, most if not all of us use it all day every day for work across the company from origination, underwriting, to mortgage admin and servicing and even MIC management. We onboarded with automator quite a few years ago and at the time it was in its infancy, and it has grown so much since then.

Cons:

Sometimes there are changes made on the backend that impact our reports, documents, or in general settings we have, and it is tough to get a resolution from the support team at times. It can cause disruption to our operations and be frustrating at times. The support team is very friendly when these issues come up.

Avalon Capital Private Lender

Pros:

When underwriting loans, it is a huge benefit to have all of the information in one place to look at all of the prior business we have done with a repeat customer.

Cons:

There is a little bit of a learning curve at first but the costumer service did a great job training my team.

Extremely effective and efficient loan management software

Pros:

The ability to run my entire business from one software stack

Cons:

It could use a UI refresh to give it a more modern look and feel

Excellent Software and one stop shop for Mortgage Lenders

Pros:

Ease of use, excellent features, one stop shop for borrowers, lenders, investors and managed funds.

Cons:

Frequent change of modules when existing modules were working well

MA has allowed us to stream line our process from beginning to end. It allows us to address problems quickly and efficiently.

Pros:

There is no better way to keep our loans organized, serviced, an monitored all in one place. We use the product every single day and it has become the backbone of our deal flow.

Cons:

There is a bit of a learning curve when it comes to modifying documents and templates.

Complete Lending Solution from onboarding to customization.

Comments: From [sensitive content hidden] on the sales side, to getting to know ownership and [sensitive content hidden] being an amazing onboarding specialist. Our experience has been flawless. Anytime we have questions, we reach out and they are answered quickly and with utmost professionalism.

Pros:

We love how our portfolio has become professionally managed just by implementing this software. Our clients love the portal abilities and we enjoy being able to generate items to our specifications without paying for extra plug ins or using other servies.

Cons:

We have had no complaints, concerning Mortgage Automator.

Mortgage Automator Response

last year

Chris, thank you so much for your review! We love working with you!

5 Stars, amazing product, excellent service, a must have.

Pros:

Mortgage Automator has been critical to our growth and success as a private lender. The software has allowed us to streamline our business processes, manage our client database and save an incredible amount of time that would be required if processing manually. The software works seamlessly with all major lending submission platforms and is extremely user friendly. The Mortgage Automator team is always available if we need anything and is continuously upgrading the software as needed. We have received lots of positive feedback from our broker channel commenting on our quick turn around times and on how easy it is to send us business. Thank you Mortgage Automator!

Cons:

I don't see any cons with this software.

Mortgage Automator Response

2 years ago

Thank you for the kind words, Zack!

Great mortgage software.

Pros:

Its robust and allows the origination process to go smoothly with document generation.

Cons:

Screens can be busy at times, more defined tabs/shortcuts/sections within a loan would be helpful as opposed to one long scrolling page.

Mortgage Automator Response

2 years ago

Thank you for your support, Arryn. We're always trying to develop new ways to improve navigation while ensuring nothing is hidden unintentionally. We would love to hear more about the specific issues you are experiencing; please do not hesitate to reach out to our Support team!

Detailed and Easy to Use System, Excellent Customer Service and Team!

Comments:

Mortgage Automator has changed our company for the better. Our processes continued to be streamlined as more features and automation are added to the software. As a team we are thrilled by the amount of new features and progress that the software has provided us. When we decided to commit to Mortgage Automator a year ago, we knew that there would be some frustrations along the way as the software developed and new features would be added over time, but we can confidently say we have no regrets making the commitment and sticking with MA through those challenges!

As we continue to use the software and identify gaps or errors, the Mortgage Automator team addresses our concerns and escalates issues to developers or simply fixes the problem by a quick look of the issue on their end. Overall, Mortgage Automator continues to provide excellent customer service and continues to save us time and effort as the software can be adjusted to fit our needs.

Pros:

We started using Mortgage Automator after reviewing several other loan management systems and decided that Mortgage Automator was the best long-run choice.. At the time, there were a number of missing features, but we took the leap and trusted that the team and system would deliver in the future. The leadership team at Mortgage Automator has definitely kept their promises! Over the past several months they have released features that have been crucial to our business. It is fast, easy to use, and reliable. A short list of the things we love: • The Kanban tile view for our in progress loans • Ability to accept fee payments via credit card • Customization specific to our company • Customization of documents created in the system • The communications module which allows us to set up rules and templates that can be triggered to send emails and/or text messages • Auto-draft monthly payments, outstanding fees and charges via NACHA file • Suggest a feature board • The support team responsiveness! They do a great job answering questions and solving problems via chat feature or email

Cons:

There are a lot of new features released or changes being made to improve the software, sometimes it is hard to keep up and learn how the new features change or affect our current loans. The knowledge based articles are helpful, but our hope is that there will be demonstration videos and best practices shared so that we can continue to use the software to it's fullest extent.

Mortgage Automator Response

3 years ago

Thank you for such a great review, Megan. We are working on releasing more video tutorials and best practices soon :)

Best software for anyone managing Mortgage Capital

Comments: Deal management & tracking have become very simple. The best part is managing progress throughout the deal with all the documents being auto generated; commitments, instructions to the solicitor etc, payouts etc. A lot of the manual work has been eliminated.

Pros:

I have used this software for a little more than a year now and I can easily say its the best software out there. It comes with abundance amount of options and beauty is you can customize it to an extent that you only see the options you plan on using. We were spending hours on manual templates and tracking process of each loan; automator has automated all the steps. All the documents can be easily generated with the push of the button. Some of the features such as complex loans(multiple investors, rate scaling, managing broker/investor profiles to easily track deals and Year end reporting) can't be found elsewhere. I'd highly recommend this for anyone investing in mortgages or anyone managing mortgage capital.

Cons:

I don't think there is not a whole lot to dislike.

Mortgage Automator Response

4 years ago

Parm, thank you for the positive review, we appreciate it a lot and look forward to delivering even more useful features.

Great Software - Greater Team!

Comments: The visually appealing and easily utilized interface combined with well designed back end processes has greatly decreased our processing time of new mortgages and provided a much more simple way to track and administer them all from work, home, or even our cell phones.

Pros:

Rapidly expanding its product offerings and ease of use, all the while maintaining excellent customer service and consistently providing helpful and speedy responses to any and all concerns.

Cons:

Doesn't upload and store documents or currently offer the option to pull credit reports.

Mortgage Automator Response

5 years ago

Thank you for the feedback, Jake. Document storage is scheduled to be released on March 15, 2020. And Equifax integration is coming in Q2 :)

Long term user

Comments: Great tool and makes the activity to run day to day business very effective and efficient. Would definitely recommend. Very user-friendly and great support.

Pros:

Upload of applications is automated. Standard documents, communication and deal stages are pre-created and automated. Support team have been excellent. Very quick to respond and resolve any questions.

Cons:

Doesn't have all FSRA documents loaded yet. Not Full accounting functionality - need a secondary accounting software.

Mortgage Automator Response

3 years ago

Alma, thank you for the review and your kind words. Regarding FSRA documents, we have a compliance document builder coming in 2021 where you will be able to add all your own forms.

Very satisfied with Mortgage Automator.

Comments: Getting our business on Mortgage Automator has been a massive shift for us and has brought positivity in all areas of our business. We have all levels of staff using it from data entry to document creation all the way up to ownership and revenue tracking.

Pros:

This software is very robust yet very easy to sue and figure out. It has helped us transform our operations and continues to allow us to streamline and improve efficiency, tracking, data manipulation ect.

Cons:

The dislikes are almost non existent. There are a few little tricks to learn, but once you do learn them any little dislikes are quickly solved.

Mortgage Automator Response

4 years ago

Thank you for the kind words, Mark. We are very happy to hear that you're satisfied with Mortgage Automator!