17 years helping Canadian businesses

choose better software

What Is Taxprep?

Corporate Taxprep has the most comprehensive collection of federal and provincial tax forms and tools designed to simplify corporate preparation requirements. It's the same software trusted by all of Canada¿s top 30 accounting firms, the CRA and more than half of all FP500 companies. Corporate Taxprep is Canadian T2 tax return software that gives you the tools you need to increase accuracy and deliver your corporate tax return results with confidence.

Who Uses Taxprep?

Taxprep is accounting software used across Canada in both English and French by Public Accounting, Tax Preparation, Legal Services, Bookkeeping, Banking, Insurance, Education, Government, + More.

Where can Taxprep be deployed?

Not provided by vendor

About the vendor

- Wolters Kluwer

- Located in Stamford, US

- Founded in 1986

Taxprep support

- Chat

Countries available

Canada, United States

Languages

English

Taxprep pricing

Starting Price:

- Yes, has free trial

- No free version

Taxprep does not have a free version but does offer a free trial. Taxprep paid version starts at US$1.00.

get a free trialAbout the vendor

- Wolters Kluwer

- Located in Stamford, US

- Founded in 1986

Taxprep support

- Chat

Countries available

Canada, United States

Languages

English

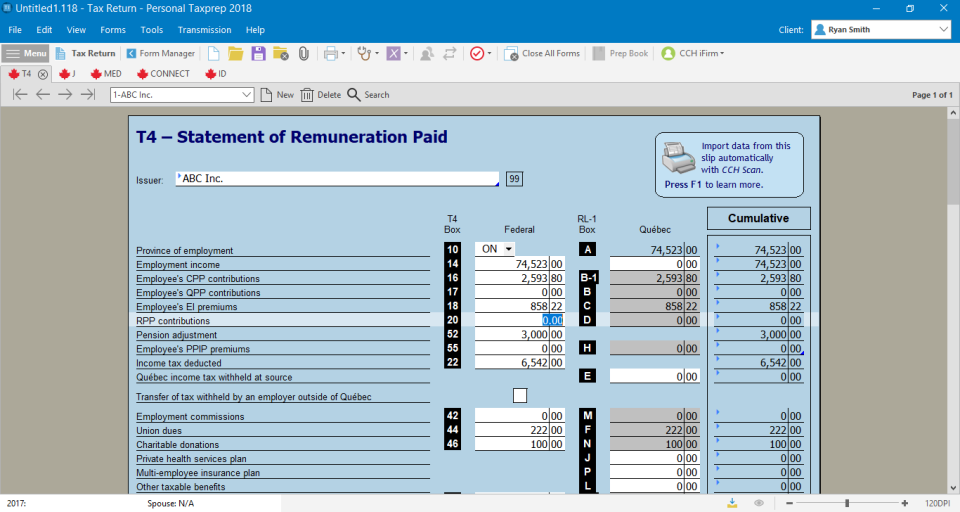

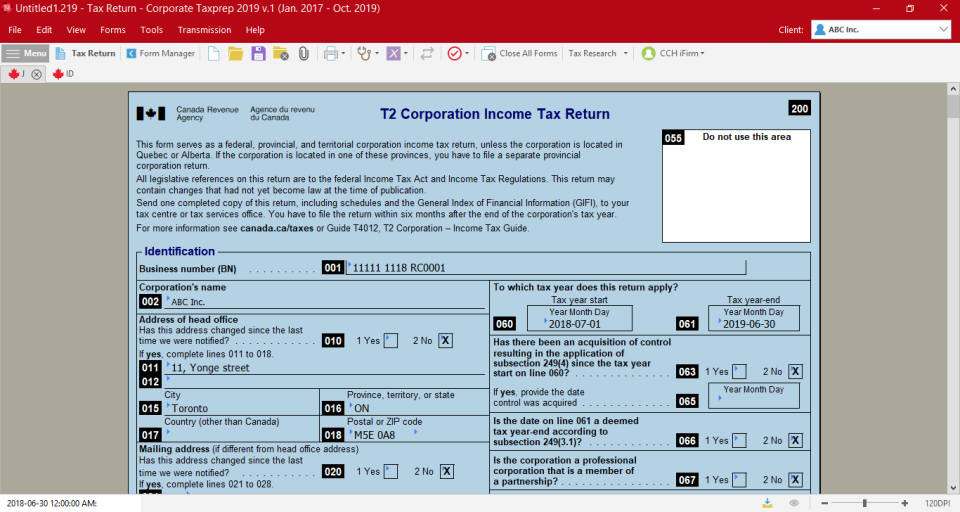

Taxprep videos and images

Features of Taxprep

Reviews of Taxprep

Excellent Program

Comments: We use Taxprep to prepare our Corporate Income Tax returns. The program never disappoints.

Pros:

Very user friendly, I can easily find any necessary forms that I require to prepare our Corporate Income Tax return. Customer service is always helpful. I also like that most (if not all large accounting firms use this software and so it is well utilized)

Cons:

It can be expensive for companies with modest budgets.

Taxprep: The In's and Out's

Comments: Overall we are satisfied with this program. The price is a bit high but we get outstanding functionality and a great knowledge base to use with out staff. We will keep using this for many years to come hopefully

Pros:

We process a multitude of tax returns for both personal and corporate. We deal with many companies and Taxprep has always been there helping us out. The programs are amazing and they offer amazing support and have a wide array of answers to many questions to help you along the way.

Cons:

Sometimes the support team can forget about you and you feel forgotten about. But the most thing I like least is the pricing. Personally I feel the price could be lower as looking around at other software's to buy the prices are definitely lower in other markets. Just something to keep in mind.

Review of T2 programs

Pros:

I have been using Taxprep for over 20 years. I am very familiar with the program. The program is relatively easy to use. I like the fact that the return on the screen is exactly the same as what is printed out. The diagnostics function is very useful.

Cons:

I have noticed a change in version 2 of the T2 2019 program which is not at all useful. When you first open the program you used to be able to see certain information about each client without going into the actual file (i.e. the status, the year end, whether the return had been e-filed etc.). Now you have to actually open the particular client file to see that information. I don't know if this an option that has to be selected but I have been unable to find the answer. Extremely annoying. Also, the program has become quite expensive, especially for a sole practitioner.

TAXPREP iFIRM

Comments: I integrated the iFIRM TaxPrep with iFIRM Portal / e- Signature, so I can offer my customers an updated tool to send their data at their convenience, from where-ever they live, from what- ever device, to my office. We still offer the option to meet in-person. TaxPrep iFirm is integrated with the iFirm Client mgmt, Time & Billing software, which allows us to update client information once, in one location, instead of in multiple data bases, and locations. The software updates are done in the "background" which has saved me hours on the weekends during Tax Season. My office uses the client "dashboard" type features from the CCH TaxPrep Dashboard tool, to track client status, notes and who is working on the file. This has lowered my stress as I can see the data from my tool.

Pros:

Product was easy to setup, and deploy to staff - simply gave them the log-in script to the firm web address. Any software product updates are done in the back end, generally overnight which means i am no longer installing an deploying the software updates on my firm server, then updating all the user accts on all the workstations. Can work on client files at the office, or remotely - as long as I have internet connection (which is an ongoing issue in the Territory where I live). Great tech support team - any questions, they were most helpful.

Cons:

Being dependent on internet connection, internet up & down load speeds. The Territory where i live has very slow internet up & down transfer speeds. Am use to TaxPrep server software where data is transferred quickly making jumping between forms or family members's forms seamless. Web-based TaxPrep iFirm has a noticeable delay . After using TaxPrep server based software for over 30 years, I am still getting use to the new way of jumping between forms, adding forms, or drilling down on linked data cells. One major issue is being completely dependent on internet connection - if the one (1) fiber line to the Yukon is cut (which happens multiple times per year), then my office is has lost connectivity and production.

Title

Comments: It is best interface and using comparing to other product of the same domain.

Pros:

It’s professional and pointed on formulars instead of simple data entering

Cons:

It is expensive, version updating process is manual, it is slow starting, slow opens files. There is a list of problems and missing features that could be implemented: - Form 21200 makes wrong calculation of amount for QST refund (reported into VD-358) - CARE form took in federal consideration the amount entered in Quebec - it should not, because some times there is no deductible amount to federal side; - When TED federal fails, it should not try to send provincial; - in TP1 should be the possibility to transfer Québec refund into conjoint automatically, now it always manual; - Where is useless diagnostics in a report of depending person. Dependant have same address, but diagnostics is asking if he lives alone and two more related questions; - Then you try to open more then 5 pdf files (after generating pdfs) it always asking to confirm, because it maybe slow down the system. There is should be possibility suppress that confirmation forever. Like check box "Do not ask this question in a future"; - There is shoud be a summary page similar to DT max summary page - that shows essential information on one page; - Then a person have self-employe income (2125) and foreign employe income, program should not calculate RQPP on this foreign income.

Review of Taxprep

Pros:

The software is much more robust than other tax software we have used. There are many diagnostics that are available and the search function works well. We also like the link with their other client management system, iFirm.

Cons:

The software is much pricier than other options. Customer support was very poor when we were attempting to purchase additional licenses. I would also consider training poor. It's hard to absorb all of the training initially when you don't know the software and you don't know the features and you don't know what questions to ask yet. They should come out after a year with an update training so the users can have much more specific questions they can ask. The multiple updates that we receive during the year is also annoying. We have to have our IT department update on each and every computer every time there is an update (which there are many) which costs us even more money. The old software we used, Profile, had an update feature that warned each user that an update was available when they were in the software and could click on a link and update themselves, without the involvement of the IT department. This is much more preferred. Our IT costs have gone up 20% when we changed over to Taxprep because of all these updates.

my comments

Comments: tax planning, and overall generation of the returns is excellent. The software often identifies filing issues and assists in focussing in on making sure the return will be accepted from CRA before filing. The help function could be a bit more comprehensive in moving to CRA data base or folios for referencing.

Pros:

difficult to change to a different software company. we understand the product and interfaced for the most part having been using it for over 30 years!! So we know where to look for issues that pop up from time to time.

Cons:

Setting up new year is a very time consuming process. The way in which the communication letters to clients, using data base to communicate blast letters to clients, or specific letters to clients, as well as user profiles from year to year could use some improvement. From a user perspective it is always an annual challenge to customize these features to suit our application. Consider we have one colour printer and the rest are black and white. So the letter to client and our invoice as well as the actual returns are printed on at least 2 different printers. And the cost of the program keeps increasing. Such increases are not easily passed on to clients when there is much competition to produce income taxes for no fee! Difficult to compete - which means you are pricing yourself out of my market!

There's competition and then there's Taxprep

Comments: Our public accounting practice produces a thousand personal tax returns and hundreds of corporate returns, so a tax preparation software is critical. We started with Taxprep about a quarter century ago. The software continues to evolve. Every few years we look at a host of other preparation software and talk to other preparers in the industry. Given our client base, with its particular complexity, we can't imagine another software handling it all. We also prepare US tax returns and have gone through numerous software providers; our terrible experience with US tax preparation software makes us realize how lucky we are with Taxprep for our Canadian work.

Pros:

Importing and exporting data - we use this in a host of ways. For example, we have developed our own processing dashboard, detailed label production that provides key data on the docket speeding intake or referencing, sharing info between files, billing management, analyzing client base for potential review issues, double checking filings, etc. Rich with nearly all required forms. Most complete of any tax software we have reviewed. Reliable.

Cons:

The form layouts often have a curious arrangement to them which is not ideal for data entry. The drill down data on multi-forms (e.g. family member names) is inaccessible to the data reporter.

TaxPrep Review

Comments: Mixed feels about the software, as the installation and updating process is terrible, and getting someone on the phone for tech support takes way too long, and they don't always have the answers. So you can spend an hour trying to reach someone, only to find they don't yet have a solution for the issue, or they need time to fix it. But when the software is working properly it does allow for efficient production.

Pros:

Teh diagnostics are generally pretty helpful. The layout of schedules is easy to follow.

Cons:

Too many patches and updates required each year. Technical support keeps you on hold for a very long time every time you call (over 45 minutes on hold). Every time there is an update or new version released, we need to download everything and reinstall, where as other software providers make the process much more easy, and simply push the updates through automatically.

Alternatives Considered: Profile

Switched From: Profile

Easy Import & Export Functions

Comments: Preparer and reviewer experiences

Pros:

Easy import, input and download of information from CRA.

Cons:

A cell ID mapping report could be made more available to tax professionals to allow for more streamlined return population.

Taxprep review Nov 2019

Comments: Good product , good customer service when required, no complaints other than mentioned above

Pros:

Easy to use although since i have been using for 15+ years familiarity also adds to ease of use.

Cons:

requirement to open different versions of the software for different years' filings. Need to manage multiple versions or if you open an earlier year's return you need to ensure the right version has been opened. Solving this issue (as Profile does) would allow ranking of 10's

Alternatives Considered: Profile

Reasons for Switching to Taxprep: Ease of use, continuity

Taxprep Review

Comments: I have tried other tax software packages as I am a sole proprietor and I do find that Taxprep is the most expensive. However, I keep coming back to this software program as it is the best out there and the one that I am most comfortable with.

Pros:

I like the overall functionality of the Desktop version. I'm still trying to get used to navigating the iFirm version of Taxprep. I like how I can link my large related and associated groups and it is just comforting to know that the calculations are correct.

Cons:

The number of overrides that occur when you import a large associated and related corporate group. To remove the overrides is just time consuming.

Quick access

Comments: The software is reliable with few bugs

Pros:

Comprehensive software that can handle almost any tax issues

Cons:

Opening old files can be frustrating. When opening old files a user is required to use the version of T2 software the file was created in and you cannot open the file with an older version of the software. It would be helpful if a user could determine which version of the T2 software the file was created in. The Profile system names to work better on this matter. The Taxprep forms e-file system as not as easy to use as the T1 and T2 e-file systems.

Long Time User

Pros:

The Taxprep programs that we use (T1, T2, T3 & Forms) are generally very reliable for both the returns/forms produced by them and their operations (rarely crash or cause other problems).

Cons:

We run the programs on a network and the Forms program requires a complete installation rather than an update when updated version of the program is released during the year. This is not a huge problem, but it does mean that an update for Forms requires more time as the settings have to be reconfigured and checked.

Only tax preparation software that we have ever used!

Comments: Our overall experience has been great. We haven't even bothered to consider switching to another product in the last 20 years and we have been using Taxprep since at least 1985.

Pros:

Accuracy, consistency of product, support available when you need it.

Cons:

Over the years there have been growing pains depending upon changes to the tax act and receiving final filing versions in a timely manner for some of our clients who want to file quick to receive their refunds. We have found the timeliness to be better in recent years.

CCH Taxprep review

Comments: Sometimes the software helps us with certain calculations where our tax expertise may be a little fuzzy. It helps to educate while being reliable.

Pros:

Taxprep has been an easy to use reliable product for years. We have never had any urge to switch products. We will continue to use CCH products well into the future.

Cons:

Physical archive discs. I receive numerous archive cd's throughout the year. Please provide a single USB flash drive once per year with the entire suite of backups.

Software

Comments: I do not like the fact that the software no longer supports Windows 7. I was using the scanning feature which required Windows 7 Pro even though at that time, Windows had a more advanced version. Now it is not supported any longer.

Pros:

I have always like the tax software because it has every schedule you could possible imagine. Other tax software programs are limited to the specific schedules they provide.

Cons:

The software is costly would be the only con of this program

BEST TAX SOFTWARE IN CANADA

Comments: We have never had a tax problem that could not be handled successfully by the software and Taxprep's support staff.

Pros:

We have been with Taxprep since the very beginning. Ease of use, accuracy and outstanding support make it ideal for a professional accounting practice such as ours.

Cons:

The software is pricey in relation to its competitors and for a small practice it can be a difficult choice. Prices increase annually.

Great app available online!

Comments: Great experience! It makes your life easy. Must try!

Pros:

It is automated and saves a lot of your time. It gives a real time experience. It saves your progress.

Cons:

Some of the features are quite complex and take more time. Also, there are some features which are not necessary.

TaxPrep Review

Pros:

The comprehensiveness of the programs to address most issues and tax situations.

Cons:

The TaxPrep letters are harder to modify and I do not like the use of "federal return" when all of my clients only file federal returns. TaxPrep is getting too expensive - annual increases are not warranted last increase was 6.5%, 5% the prior year and 7% the year before.

Taxprep Review

Comments: I have been using Texprep since almost day one and have been relatively happy with it. It is becoming extremely expensive and harder to use. The new so called enhancements have not improved the program and has been a learning curve headache.

Pros:

Jump codes hardly ever change It is easy to set up the program except the client letters

Cons:

Location and size of the icons Client letters are difficult to set up .

Taxprep is one of the topmost software

Comments: Overall a good software for beginners as well as experienced

Pros:

Easy to understand and use as a first time user.

Cons:

Cant say that there are any cons. But, found bit difficult to integrate with quickbooks

Great application for an accounting firm

Comments: I use it every day : Taxprep T1, T2, T3 of Forms ar part of my daily work load. Always happy to see the resulting documents because it is efficient.

Pros:

It works great : efficient, easy to use and the real-time impact on the bottom line is appreciated.

Cons:

Expensive, but we need the exact information reporting, so we buy again and again.

Industry Standard

Pros:

This software is the one of the best softwares in the industry, and it has been used at my last 3 employers. The learning curve is slightly steep for those without a deep understanding in tax, however, once you get the hang of it, the software is quite intuitive.

Cons:

I would absolutely love to be able to open to instances of the software and view two tax returns simultaneously on my two monitors. This way I can compare with the prior year, and I can compare it with other companies to ensure consistency across groups, and years.

TaxPrep Review

Comments: We have used Taxprep for over 15 years and it is user friendly, competitive price and updates are regular.

Pros:

Taxprep is user friendly. It is easy to set up the profile each year. Updates are received on a regular basis.

Cons:

The only Taxprep program that is not user friendly is Taxprep for Trusts.