17 years helping Canadian businesses

choose better software

PayNet Banking Platform

What Is PayNet Banking Platform?

PayNet provides White-labeled neo-banking and Payment software solutions to enable Payments

We have ready-to-use modules and pre-built apps to launch

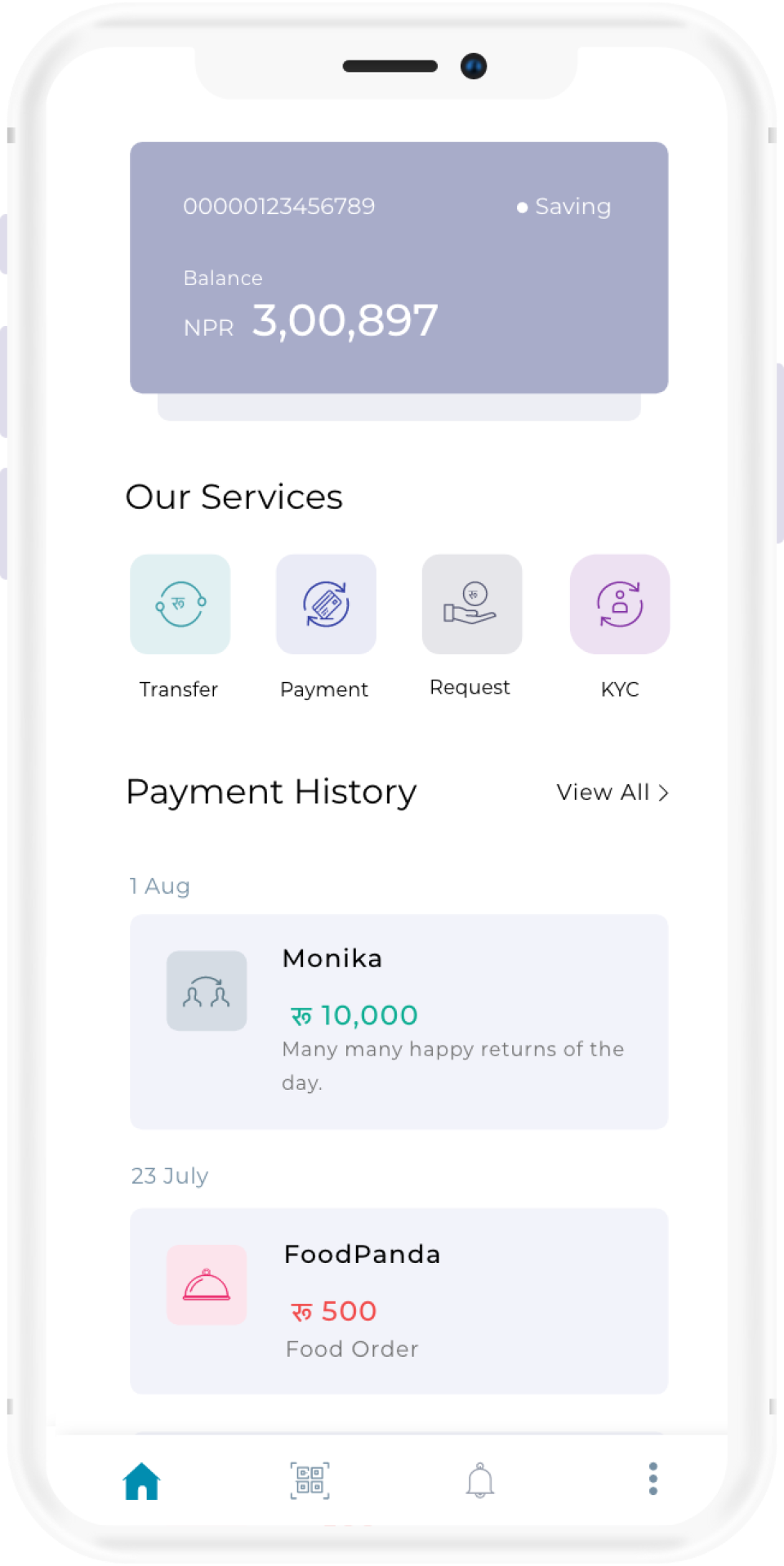

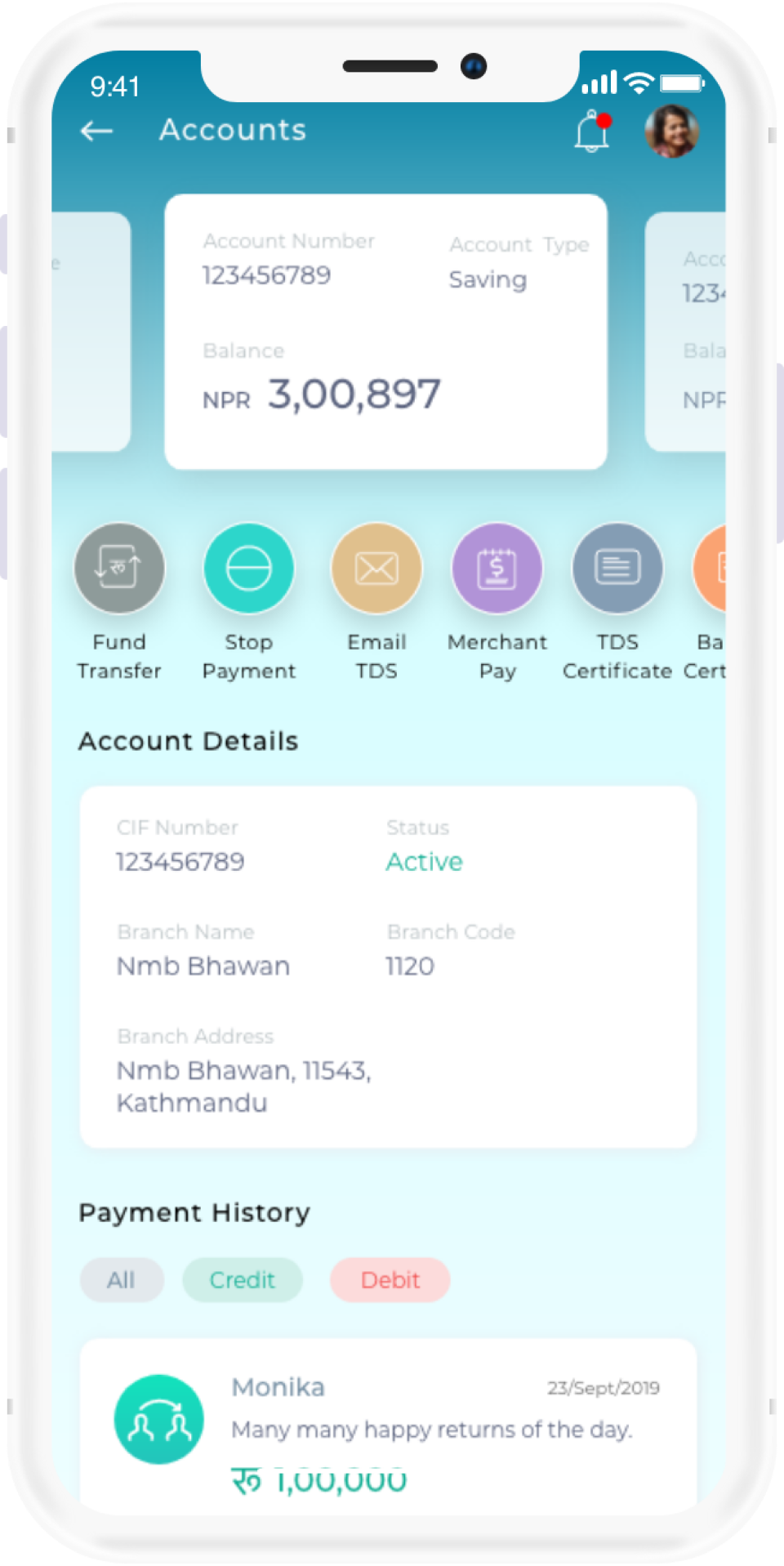

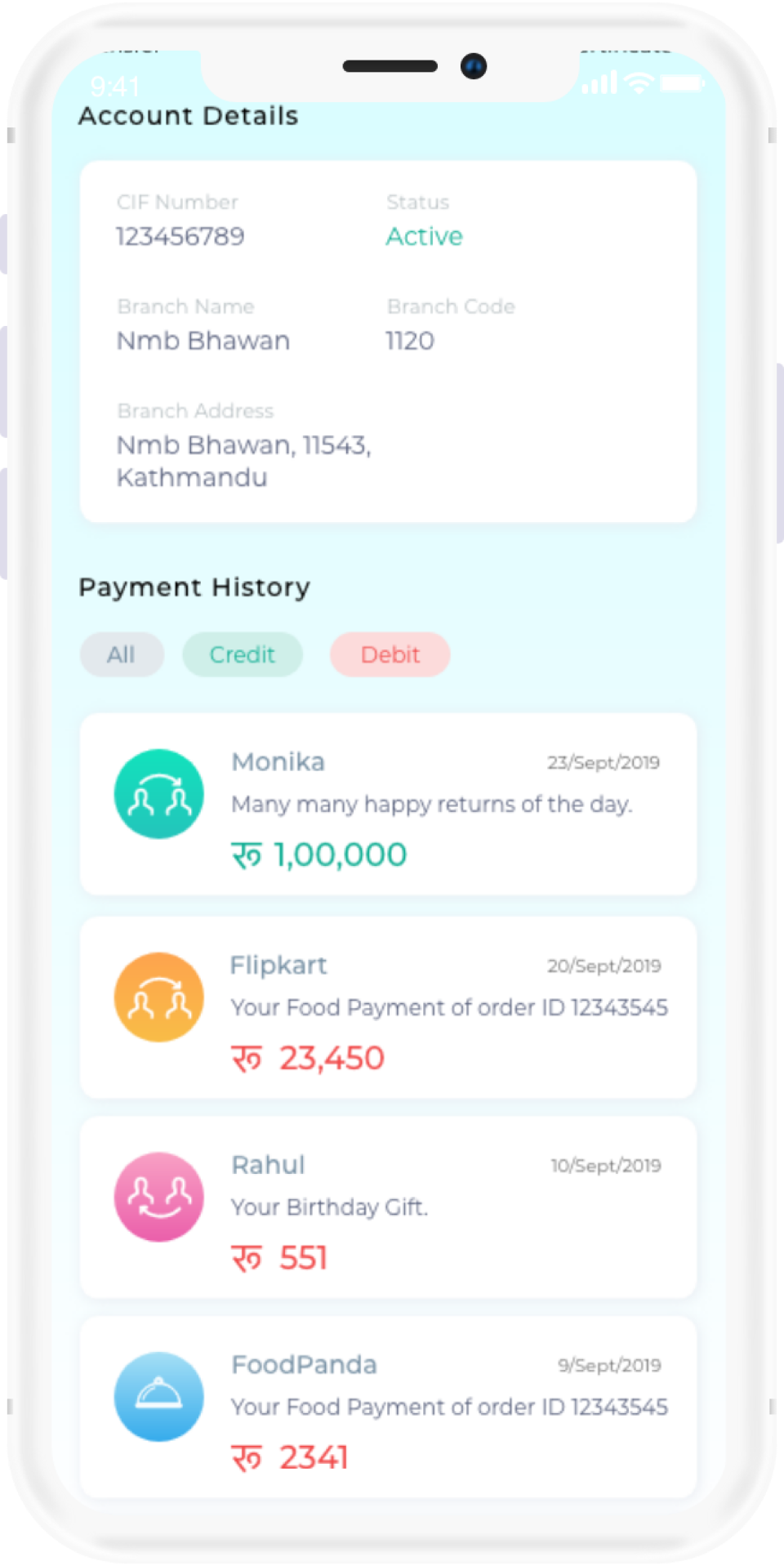

- Corporate and Mobile Banking

- Digital Wallets

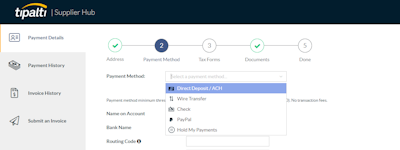

- Payments and Collections

- Loyalty and Rewards

Benefit :

To go to market 10 X faster

50% lower maintenance cost

Data Security Certified

Who Uses PayNet Banking Platform?

Banks NBFC Fintech Startup

Not sure about PayNet Banking Platform?

Compare with a popular alternative

PayNet Banking Platform

Reviews of PayNet Banking Platform

Personalizing the Banking Experience

Pros:

Banking before digital transformation is like this huge excel file with hundreds of sheets about millions of people, which carries hundreds of potential patterns & data points of every individual that are not organized and interpreted for business development but duplicated and considered a hassle to manage. But, with an omni channel digital banking solution it not only organizes your data but also identifies patterns and data points to notify and connect you with potential leads/ opportunities. Alongside It gives your team the freedom to innovate & cultivate strategizes in alignment to your organizations values & visions.

Cons:

It's a long & tedious process of integration. It requires a lot of time investment and devotion from key people of the organisations, hence finding the hours for already ongoing projects or daily work might be affected.

Alternatives Considered:

Excellent software and partnership

Comments: Great product and company

Pros:

Commitment, support, flexibility, cost effective, business modeling

Cons:

None to be honest, paynet system gave us more than we expected not only current requirements but also future.

Best In Class

Pros:

Best team of professionals I ever cooperated with. They you know every single details in both business and technical aspects .

Cons:

Nothing to mention. you just need have a detailed scope of work and make sure that you have the best PM on the implementation.

NMB Bank Omni Channel Banking

Comments: We are still in the implementation phase, but till date the implementation is as per the requirements of the bank and the scope of work as agreed. we are yet to go public but the feedback from the soft launch is impressive and it has given us more energy to implement this product as a integrated channel for all the banks business offerings.

Pros:

The Product is build as per the Scope and is different than the traditional Mobile and Internet banking, the Clients of the banks will get the same experience in all the channels. As the system is still under implementation we have lot to do and the team behind this are working round the clock to make things as per the scope. The team has built the system in such a way that bank can implement any client needs easily.

Cons:

No Comments on this, as we have long way to go. but till date what has been delivered is up to the mark and hope the team will delivery rest of the scope as expected.

Experienced and responsive

Pros:

I should stress the architecture, rich functionality and reliability of the system as well as highly professional and responsive team

Cons:

We look forward to next iteration of currency exchange functionality

FEEDBACK

Pros:

ITS EASY TO NAVIGATE THE PLATFORM I.E IT'S USER FRIENDLY

Cons:

NOTHING COMES TO MIND AT THE MOMENT, AS STATED ABOVE NAVIGATING THE SYSTEM WAS OK.

Paynet Viber Chatbot for Vianet Review

Comments: Paynet team has been very professional and responsive. It has been a pleasure working with them and hope to have the opportunity to work on more projects in the future.

Pros:

Chatbot provides instant resolution to customers' frequently asked queries & issues. The bot is very easy to use and is more accessible to our customers than our previous web and mobile app implementations that fulfilled similar tasks. Its simplicity both to implement and to use would be its best feature.

Cons:

We would have preferred a more graphical interface than the current text layout. We also think multi-language support is a must which we hope to implement in the future.

Wonderful platform

Comments: Wonderful platform which has a single feature hence making our and our client's daily operations much easier and faster

Pros:

The ease of operation , which is secure and global standard. The Paynet solution can be easy to integrate in any social media based service platform

Cons:

The chatbot based application needs to be faster for transactional features

My experience with the PayNet Team

Pros:

Scalability, reliability and convenience

Cons:

None.

Reliable Digital Platform

Pros:

Unique and robust. Have all the required ingredients for a digital platform

Cons:

Must have some other customization and other new features

Good

Comments: Paperless and no need to visit bank or ATMs.

Pros:

Online account opening and integration with our intranet software.

Cons:

Mini Statement and Fund Transfer along with simplified real time account opening

Dynamic and robust solution

Pros:

Whatsapp integration is the most unique and impactful solution.

Cons:

Good one. need to bring lending facilities in this platform

Ease of use and quick to deploy

Comments: Very happy

Pros:

Lots of relevant features, quick to deploy

Cons:

A local support is needed. UI can be improved