17 years helping Canadian businesses

choose better software

Airwallex

What Is Airwallex?

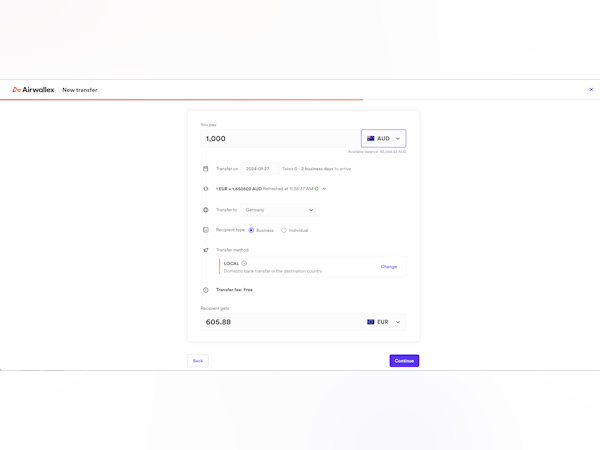

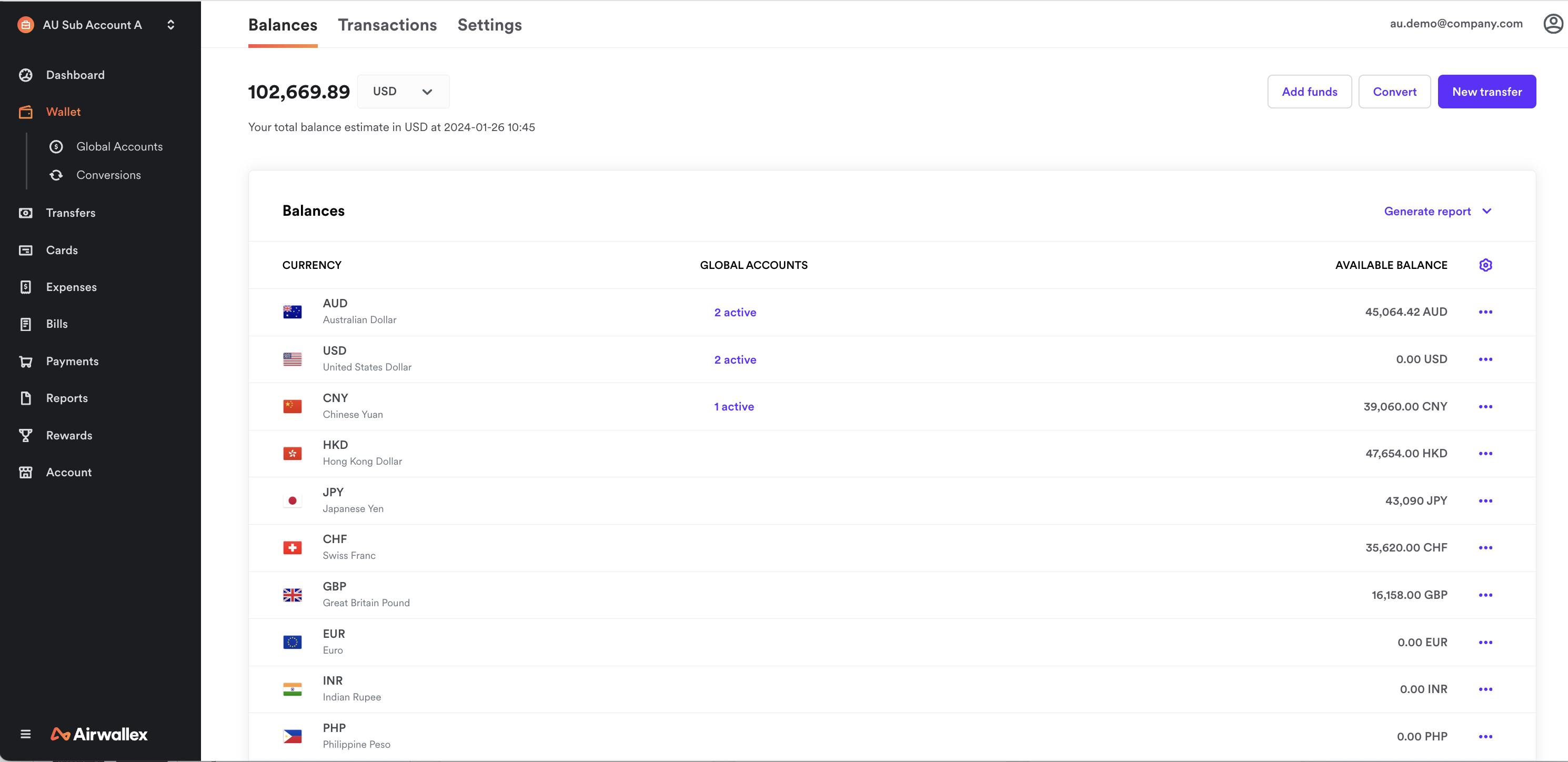

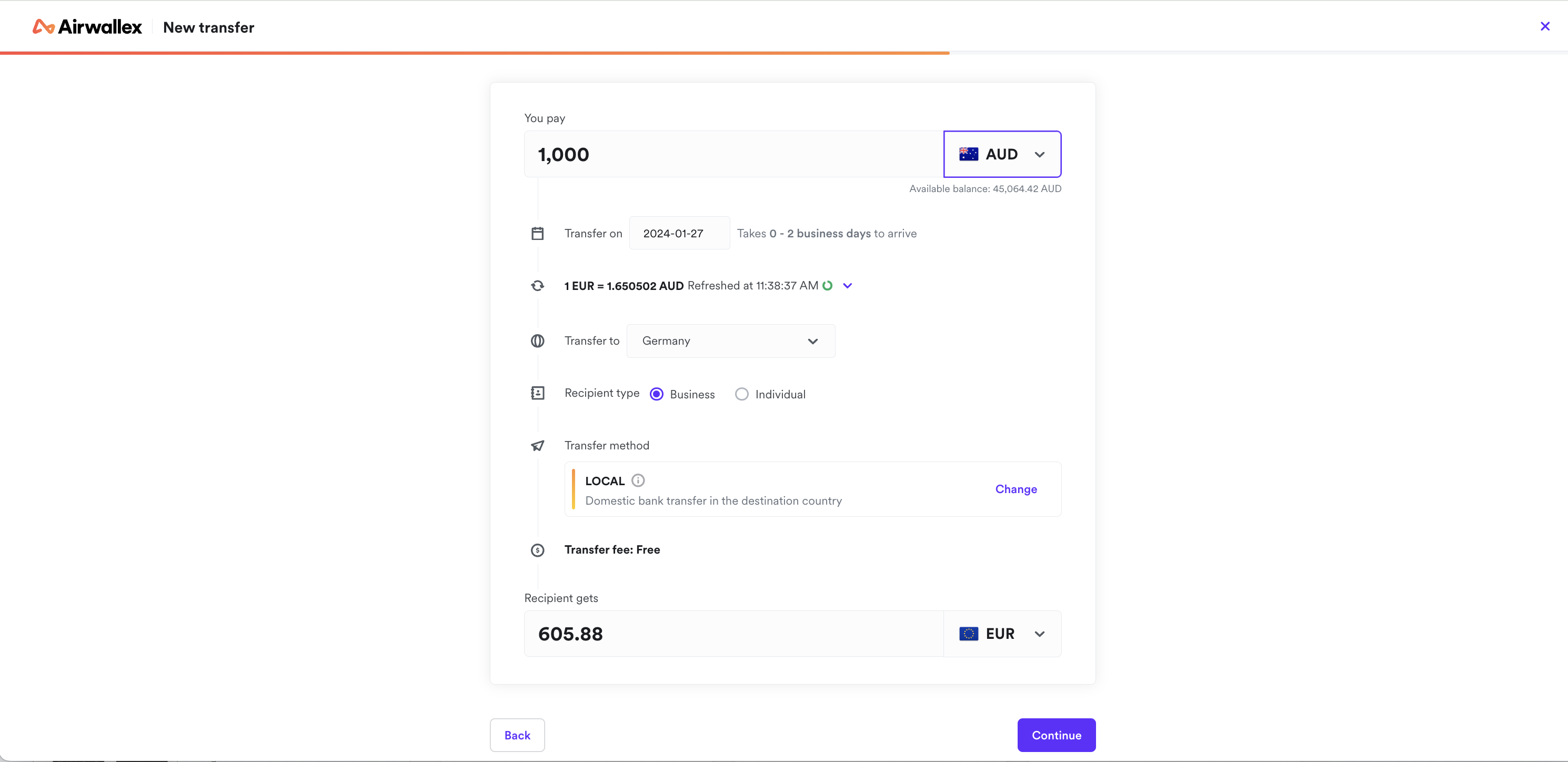

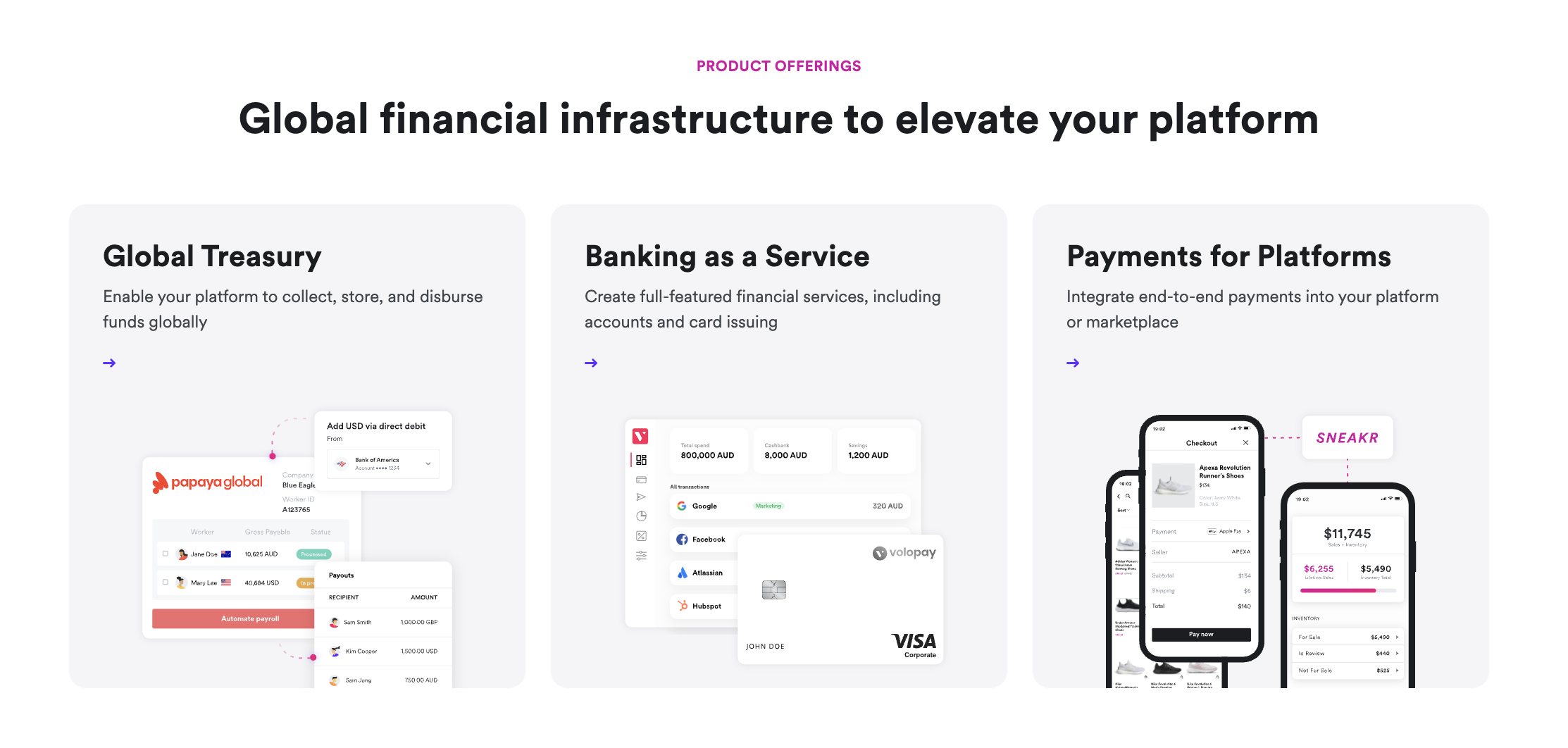

Airwallex's cloud-native platform has been engineered to take the friction out of your global payments and financial operations. Whether you're a global business looking to save time and money as you scale, or a forward-thinking enterprise that's ready to build your own financial products, Airwallex's leading technology can support your growth. Unlike legacy banking, Airwallex gives you the speed, simplicity, and savings to seamlessly operate your business across borders.

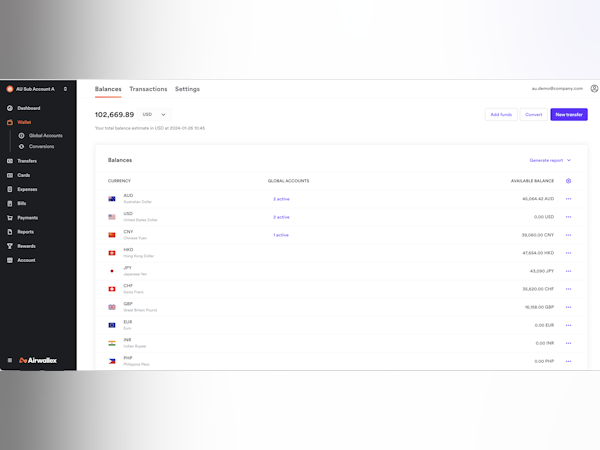

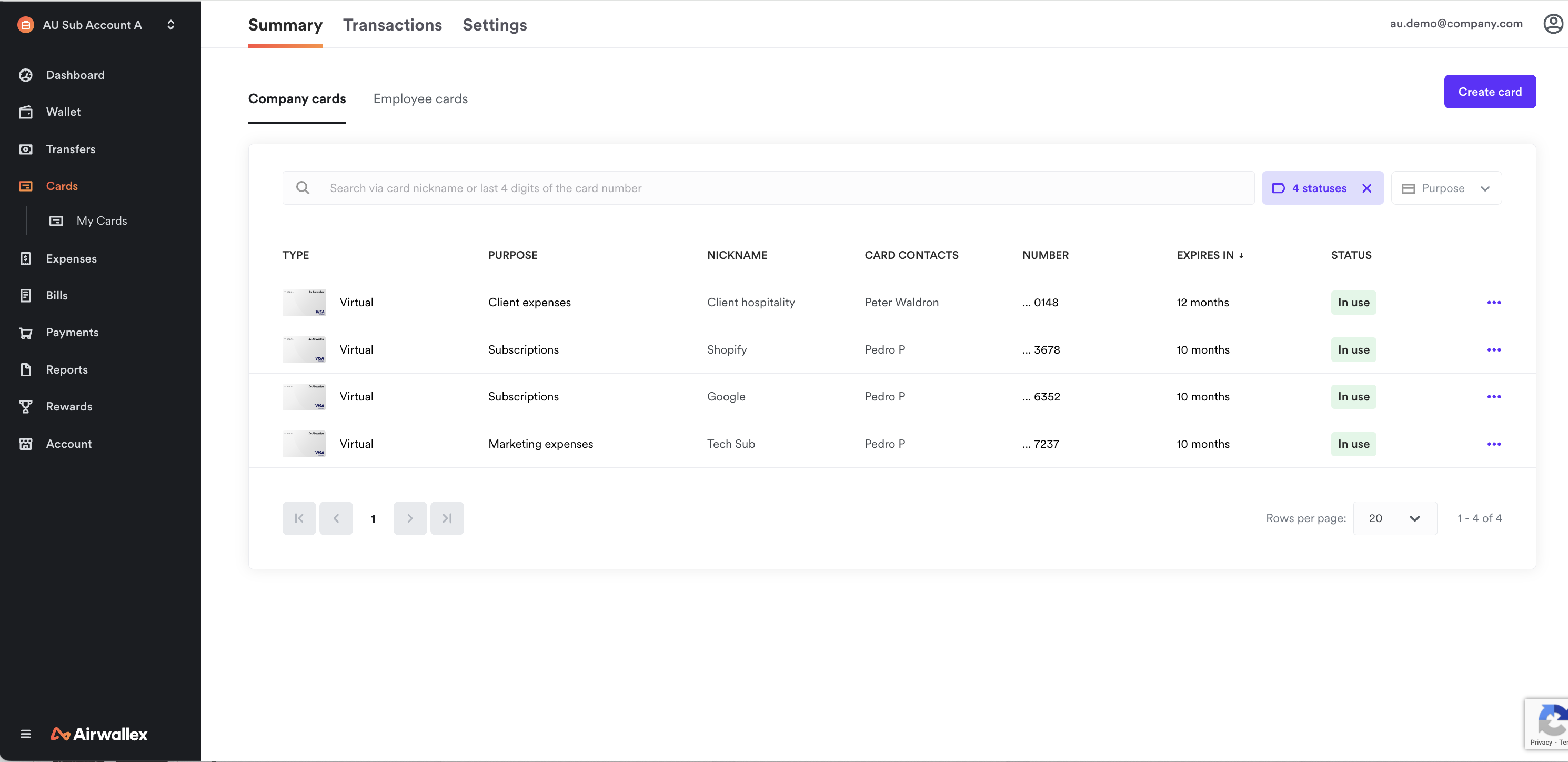

Manage everything from online payments, treasury and FX, to spend management - all via one secure Business Account that can be accessed via desktop or mobile.

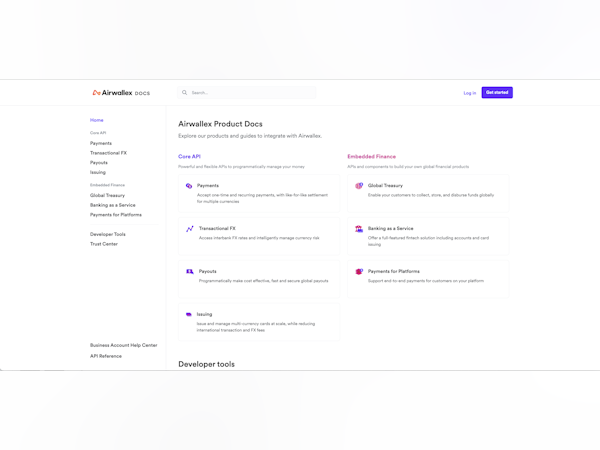

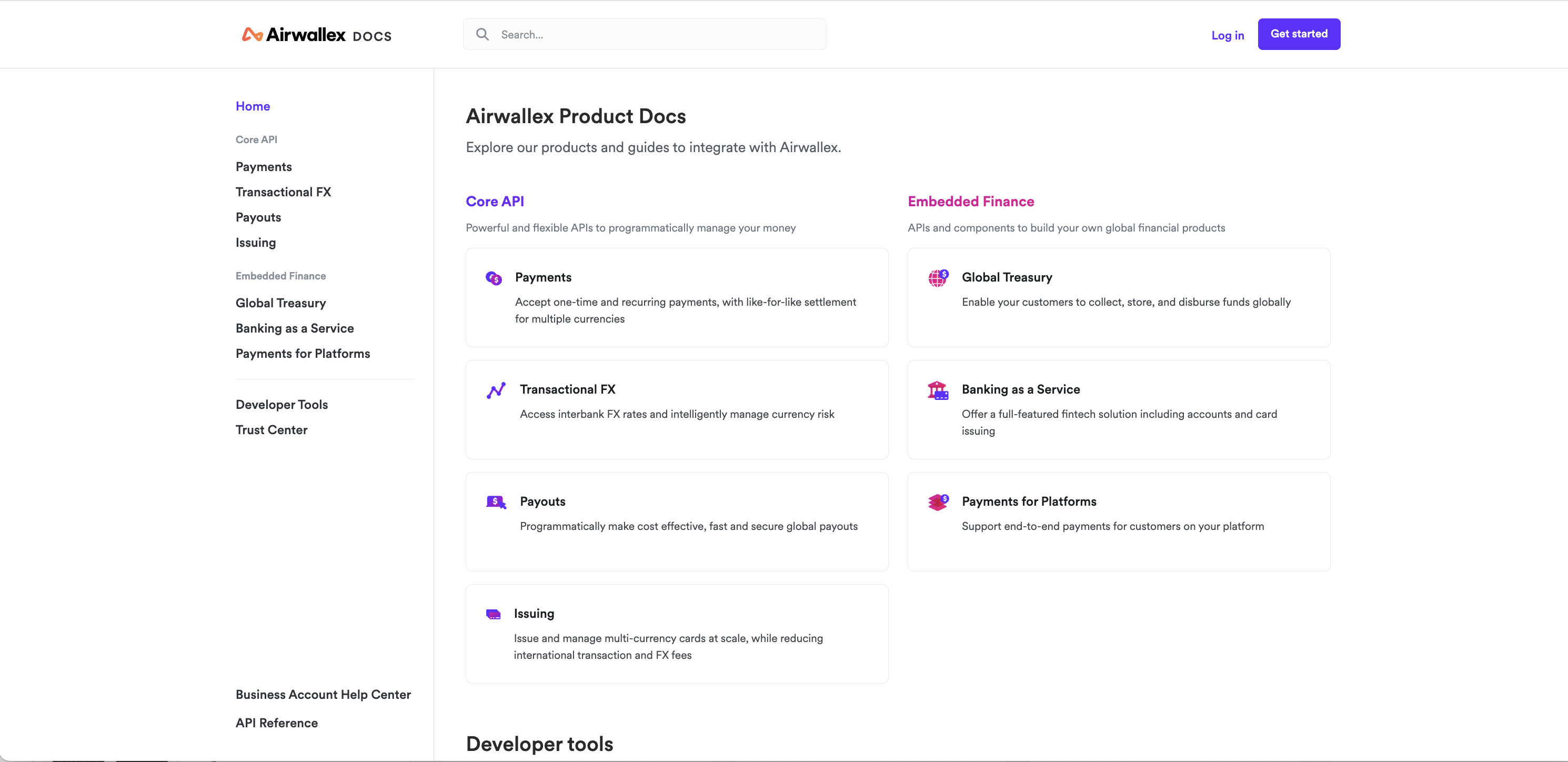

If you’re looking for a more customizable and programmatic solution to manage and move money, you can integrate directly with our Core API.

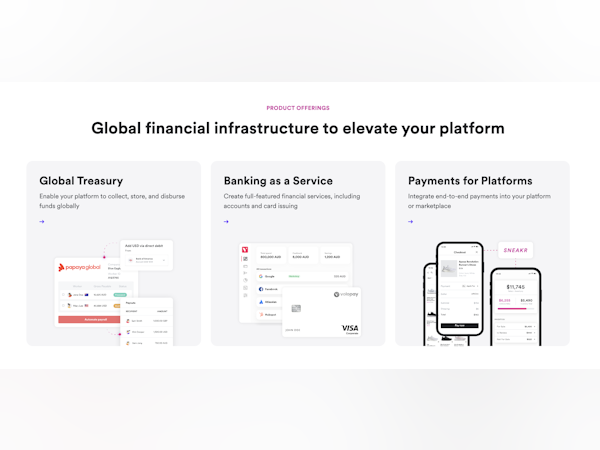

And if you’re a platform or marketplace that’s looking to generate new lines of revenue by offering your own financial products, you can tap into our powerful Embedded Finance solutions.

Who Uses Airwallex?

Airwallex supports SMBs in transacting internationally in minutes as well as Enterprises that want to scale their financial operations or offer their own financial products globally.

Not sure about Airwallex?

Compare with a popular alternative

Airwallex

Reviews of Airwallex

Airwallex has significantly cut down on payment fees

Comments: For those willing to wait -- a great cost-cutter.

Pros:

After switching from PayPal, my fee of 4 % was reduced to $ 4 for the same service.

Cons:

The service can take longer than receiving or sending a payment through PayPal.

The best transaction account for digital business owners.

Comments: The best of all the business accounts we've had so far. We use this conjunction with Wise and eliminated traditional bank accounts saving us tons on FX fee and payouts.

Pros:

A simple and everyday business transaction account. Integrates with Stripe, Zapier and Xero for simple end-to-end workflow customisation and management. Can issue multiple spend cards for different categories and competitive FX rates but super quick conversion. Best for users who charge in USD but also have freelancers working globally to manage multiple currencies.

Cons:

Nothing as such. Partner offers could be expanded.

Airwallex – Not a fan of their onboarding and decision-making

Comments: Disappointing, and I'm frustrated by their lack of transparency, and arbitrary process. It feels unfair, biased, and lacking in credibility.

Pros:

It's a lovely interface, and they support a lot of currencies. Their UI is really strong, and it feels like a nice modern service.

Cons:

I went through the KYC and business sign up process for my consulting business which has a 6 year operational track record with no issues. They rejected my application, provided no reasoning why, and I'm entirely within their acceptable use policy. So you can judge for your self, I provide marketing consulting services. It's mystifying, and disappointing. It also took then less than 10 minutes to process but they claim to follow a thorough review process. I am dubious about their claims, and reasoning.

Accelerate global payments and transfers with Airwallex

Comments: Excellent way to manage multiple currency transactions and transfer and make payments across globe with less fee and with great security to wired money.

Pros:

Easy to open foreign currency account and synchronize your multi-currency transactions into one platform and transfer funds across globe with less fee.

Cons:

Nothing to dislike about Airwallex. Easy to get started and easy on integration to streamline global financial operations.

Fast global payments

Comments: Good overall

Pros:

My company uses Airwallex for payroll and the team receive their money within 10 hours since the file has been uploaded. Fast.

Cons:

They do not provide an option to verify with a national ID in order to get a virtual card. My employer tried to add a new card in the company account and link it to my personal details but Airwallex only accepts a passport for verification (which in my country costs a lot). I sent them my national ID but they could not accept it (I live in the EU).

Payment software that has a lot to improve

Comments: Overall it is a simple tool for making foreign currency payment. But the simplicity is both the pros and cons. Cons is the lack of control detail like a bank website, pros then is its simplicity to setup.

Pros:

Simple installation, easy to setup, simple choices of user roles.

Cons:

Lack of control and ability to set up multiple approval roles for users. There is a OTP one time password feature, but it is needed for each payment, cannot apply for batch payments. Bank feed to Xero is also not stable.