17 years helping Canadian businesses

choose better software

Tax1099.com

What Is Tax1099.com?

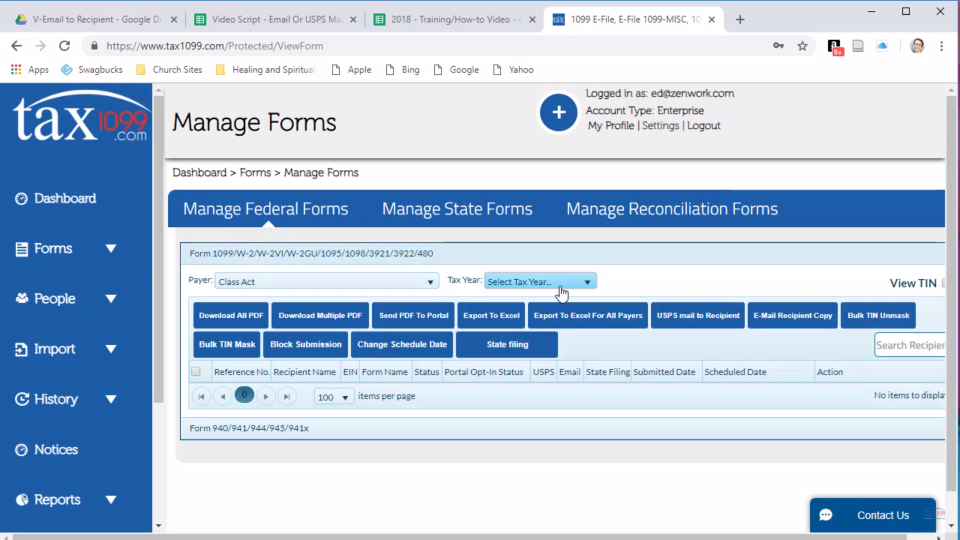

The complexity of tax regulations can be overwhelming and make filing complicated. Our comprehensive software makes it easy to file your taxes accurately and quickly from start to finish. Tax1099 is approved by the IRS and provides an intuitive interface and powerful features that help you get the job done. eFile your 1099, W-2, and other forms with ease. Our software is secure and reliable, helping you ensure compliance with IRS regulations.

Who Uses Tax1099.com?

Designed for small businesses, independent accountants, bookkeepers and CPA firms in USA and Canada, it is a tax practice management solution that enables to electronically file 1099 or W2 forms.

Not sure about Tax1099.com?

Compare with a popular alternative

Tax1099.com

Reviews of Tax1099.com

Simple and easy

Comments: I really like this it’s easy and simple to use. I’m Uncle and two years ago. I was literally filling out the 1099 and mailing them to the IRS so this is definitely a new way for me that’s so easy.

Pros:

I like that it’s simple and you can go on there and do different updates if needed

Cons:

It’s not really anything that I don’t like about it

Alternatives Considered:

Easy 1099‘s

Comments: Every year Tax1099 has reliably allowed me to quickly provide and file my year end tax forms to subcontractors. The program hasn’t changed much over the years which I LOVE because why complicate things?? Stress free tax filing. Can’t beat that.

Pros:

I love how easy it is to enter data and create forms. I’ve been using Tax1099 for at least 8 years now. I like that my prior year vendors are saved, so less data entry. Best of all, I can email or have Tax1099 mail the forms by postal mail to 1099 recipients for a very small and reasonable fee. If you have a small business you cannot get better than this. So easy to use. Not one of those apps that makes you want to pull your hair out. Simple, reliable and uncomplicated - and very reasonably priced.

Cons:

I honestly cannot think of a con. This is my least frustrating task of many.

DO NOT RECOMMEND! NO HELP! SOFTWARE UI ISSUES! No acknowledgement. Ignores responses to requests for video evidence of issue.

Comments:

On April 30, 2024 I decided to try Tax1099 to get my taxes that weren't received by mail, submitted.

It is May 10, 2024 and 8 of 20 submissions are marked as Submitted instead of either rejected or approved by the IRS. They keep telling me they are looking into it and then ignoring most of my emails.

Their software has a modern view and a classic view.

My first experience was a bunch of returned submissions from the IRS due to small processing, like putting breakdowns per month for under $2500 on a 941 when it's only supposed to be for $2500 and over. And a checkmark not being selected.

Thus began the process of submitting 20 tax returns. My first experience was to attempt to resubmit in Modern view. I was not given the option to edit the forms as I had seen before and wasn't sure why, so I then completed the new form it gave me when I clicked edit, thinking that was what I had to do. I completed and submitted and was recharged for two of those submissions. I then found classic view and it was allowing the edit and resubmit without being recharged. The software broke. I was asked to send video screenshots of my experience ( I have background in IT so this was understandable )and those were never addressed. I kept getting told they forwarded it to the right team. I have yet to still have anyone at all in any of the emails address my request for refund of both items that the software didn't allow me to follow proper procedure for, thus recharging me. And at that time, I was a new user and didn't know what was happening. The two new submissions were accepted immediately, therefore the ones that the originally charged me for are invalid now, and it was a software issue that caused the problem. I should have a refund.

NOW TO THE BIGGER ISSUE:

I still have 8 submissions that are marked as Submitted meaning the IRS has done nothing with them. They are, I'm sure, stuck in some queue on Tax1099 side, but show as waiting for the IRS. I believe this because all of my other resubmissions that have been done, 12 of them now, have been accepted or rejected in hours. It is now 10 days.

Because they have ignored and not addressed, nor taken accountability for the issues described above, as well as not acknowledged receipt of video evidence of the issue, I haven't even brought up the solution of refunding me the 8 and allowing me to submit them as new filings since the others appear to be stuck. IT IS OVER TEN DAYS WITH NO RESOLUTION!

I have not called the IRS to complain yet about the service yet but I will be if it isn't fixed soon. This is causing my business to have even more costs building. This was supposed to make things easier and more guaranteed to be received at the IRS over the USPS and instead here I am waiting for almost 2 weeks for no resolution to ANY of my issues I have faced.

Pros:

When I first tried to use it, it seemed simple.

Cons:

The belief I would be saving money. The UI issue that caused me to pay for duplicate submissions. Ten days of a status that seems to be an issue on their end but they are blaming the IRS. Customer service lack of response. Lack of accountability. Customer service refusal to address the refund of the issues from the UI even after submitting video evidence several times and not being acknowledged. The broken Modern view that caused me to pay for new submissions because clicking edit didn't take me to edit, but to a new form, that they made me pay for (prior to knowing there was a classic view, that worked appropriately)

Excellent 1099 E-File Program

Comments: Excellent program that makes it easy to e-file and mail 1099's in one transaction.

Pros:

Ease of use, low prices and the fact you'll mail the forms to clients for me.

Cons:

Would like it to be somewhat easier to download a PDF copy of 1099's that included the 1096.

Wonderful Service!!

Comments: I love it. I have been using it since they changed the 1099 form and will continue to use it for all my clients. I have recommended it to several people and know of at least two that are using it now. I did not know about the referral fee when I recommended it.

Pros:

I love this service. I used to do all my 1099s from QuickBooks, and most of the time they do not line up correctly with the form and it looks sloppy. These are really clean forms. The price is also better than any other service I found online.

Cons:

When they email the recipient, it is a complicated process for the recipient to retrieve their form. Normally they come back to me asking about it. I have started sending out detailed instructions to them so they can all retrieve their forms.

Great System For 1099's

Comments: Its been great experience. I have refereed this site to several clients who do their own year-end filings.

Pros:

I like how easy the system is to use for all sorts of tax filings. I mostly use it for 1099s for my clients but its really nice to have other options.

Cons:

Sometimes the link between QuickBooks and 1099.com does not work, so we have to hand type in the information for each filing.

Unclear steps

Comments: Overall, I think it's a great product but needs some fine-tuning especially for those who have never used it before.

Pros:

I like that there's no paper 1099s and love the efiling. Some of the steps seemed pretty easy to go through.

Cons:

Some of the steps were not explained very well especially when asked about the password and then -N. when you put the password in, it looks like it stops - so that was very confusing. I quickbook helper said to just keep on typing and it'll work. How are we supposed to know that? Why not make the box bigger to put the whole password in and the -N? Very very confusing. ALso didn't know to look at my email after that part. How would I know? No explanation. Also never worked with excel before, so that part was a little confusing about the sheet 1 on the bottom.

Great Tax Form software

Comments: Overall experience has been very positive.

Pros:

It is easy to use at a low cost. I do not have to look for forms etc. Just fill in the info and Tax1099 does the rest. I love it.

Cons:

Not sure I have found anything that I don't like about it. It has a lot more to offer than the small part I use.

Cheif Exec Officer

Pros:

Very easy to upload data and populate forms

Cons:

There was nothing significant about the product that I did not like

Makes filing 1099 a breeze!

Pros:

Once the initial setup is done entering contractor information, filing is quick and easy.

Cons:

I guess for me the only con is having to enter contractor information. However that has to be done no matter what service you use.

Tax1099 for efiling

Comments: I've been using Tax1099 for many years and have been happy with the experience.

Pros:

For a very reasonable fee, they will efile, mail and email your annual 1099s. Great since I can keep the history for multiple clients, makes filing each year easier.

Cons:

Can be a bit hard to navigate and find the filings once you've submitted.

Pros of Tax 1099 vs QB online

Comments: Positive. Just wish there was more Q&A with live support.

Pros:

Files 1099's in state as well as fed. other services only do federal forms.

Cons:

Customer support is not easily accessible and it is difficult to revise forms when needed without support.

Easy, Simple and Quick to Use

Comments: Its been good overall, its been helpful in being able to file last minute forms or when the post office was not open, so this has become the way to file all payroll forms and 1099's

Pros:

Tax1099 is great for e-filing, its simple and quick and secure saves times and money from having to go to post office and pay for certified mail en order to get confirmation of the forms being filed. Set up is easy.

Cons:

At login I was seeing the old files, took me a while to find my recent submissions, as it continued to show the old filed documents.

Is Tax1099 Right For You?

Comments: On the whole, great. I am a problem solver, so when I have had issues I have figured them out. The one time I absolutely need a live person, I was able to Google search that Customer Service. It was not on the Tax1099 site.

Pros:

Easy sign in, easy setup, easy input, easy review process, easy to have Tax1099 submit to tax authorities and follow up, low costs compared to other methods.

Cons:

Customer service has been a drag lately. Not having the ability to call and talk to someone. Having to only email support or use ChatBox does not work well in my case. I want a live person. Other sites have a constant live person option.

This product is Excellent Highly Recommend!

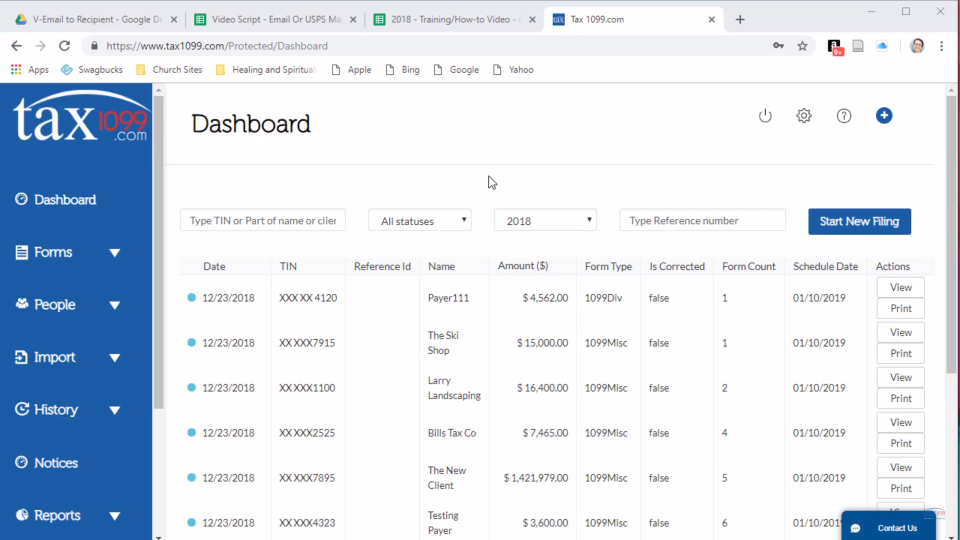

Comments: Switching to Tax1099.com was the best decision I have ever made. Not only because it makes sending out the forms and filing super easy. But I don't have to worry about something getting lost in the mail. One look at the dashboard and I know if everything has been filed and accepted by the IRS. I didn't have that when filing paper forms.

Pros:

This product has saved me time and money. Prior to using I was buying software and printing and mailing all the 1099's and the 1096's. Now not only can I do the 1099's in half the time but can also be confident that everything is filed on time and completed.

Cons:

The only thing that I found a bit difficult using this product was if a vendor happened to be in the US military. Entering the address is a bit tricky. But if you used the online help it gives you the exact steps to do so.

Bookkeepers Dream

Pros:

Easy to use. Very clear on steps that need to be made, so you won't goof up

Cons:

I use the social security check function for just one company. Hoping for a way to be able to set up that company so when I log in I won't need to go through so many steps.

Good resource for filing

Comments: When I started with the organization, we mainly used it for a few 1099s. As we changed, we took payroll in house and Tax1099 made it easy to file the forms.

Pros:

It is easy to use. I can upload my data in Excel form. They are on top of IRS requirement changes.

Cons:

I had some issues last year getting to some reports. But the support group was able to help me. It wasn't intuitive though.

Tax1099 for January returns

Comments: As a whole, I have enjoyed using Tax1099 the past 2 years

Pros:

I like how user friendly it is for training new people as well as the ease in having everything roll from year to year. I have found this to be super easy to train and allow individuals to use and work on their own without much guidance.

Cons:

There are some functions that are limited based on permissions given. This can be confusing for some people when they are not given those permissions.

Tax1099 is outstanding

Comments: I like it very much, and I plan on to continue to use it.

Pros:

I like the way it's so user friendly. I don't feel lost or unable to locate what Iam looking for because it is right there.

Cons:

I don't like where the curser placement is in the data entering boxes. It moves to the end.

end of year

Comments: The price and ease of use was great. I had no issues once I understood the format.

Pros:

Ease of use and it saved info from prior year

Cons:

It was not always easy to find the reports to download for client

1099's simplified

Comments: I have had a great experience. I started using this at a previous job back in 2017 and brought it to my new posistion in 2021. Very happy with the site.

Pros:

It just makes the process so much easier.

Cons:

I honestly do not have any cons at this time. I use this once a year just for my 10099's

Must try this for tax needs

Comments: I have not had any bad experience, easy to use from the first day I tried it

Pros:

I like how easy it is to use and how there is safe storage for my documents.

Cons:

I have not had any issues using tax 1099. I like it.

Super Easy way to Send 1099s to my Subcontractors AND the IRS

Comments: Easy to use and fast to send 1099s to my subcontractors. I love that they can receive them via mail or email.

Pros:

Inexpensive way to send 1099s to my subcontractors and have them filed with the IRS. As a Single Member LLC, it's a task that I would otherwise dread without the help of Tax 1099.com.

Cons:

No issues. Easy to use. I had no problems.

Makes 1099’s easy

Comments: I’ve used Tax1099 for years to submit 1099’s for subcontractors & it’s so much easier than locating a form- being sure you are completing correctly & submitting correctly. This is quick and easy

Pros:

Using Tax1099 was much easier than IRS - no forms to print or attempt to complete correctly

Cons:

No con of using this Zero problems using this site

Like Butter

Comments: great overall experience, it is a simple system to work with and use.

Pros:

Ease of use, simple and straight forward

Cons:

none, if you can enter the data the site does the leg work for you.