17 years helping Canadian businesses

choose better software

What Is timveroOS?

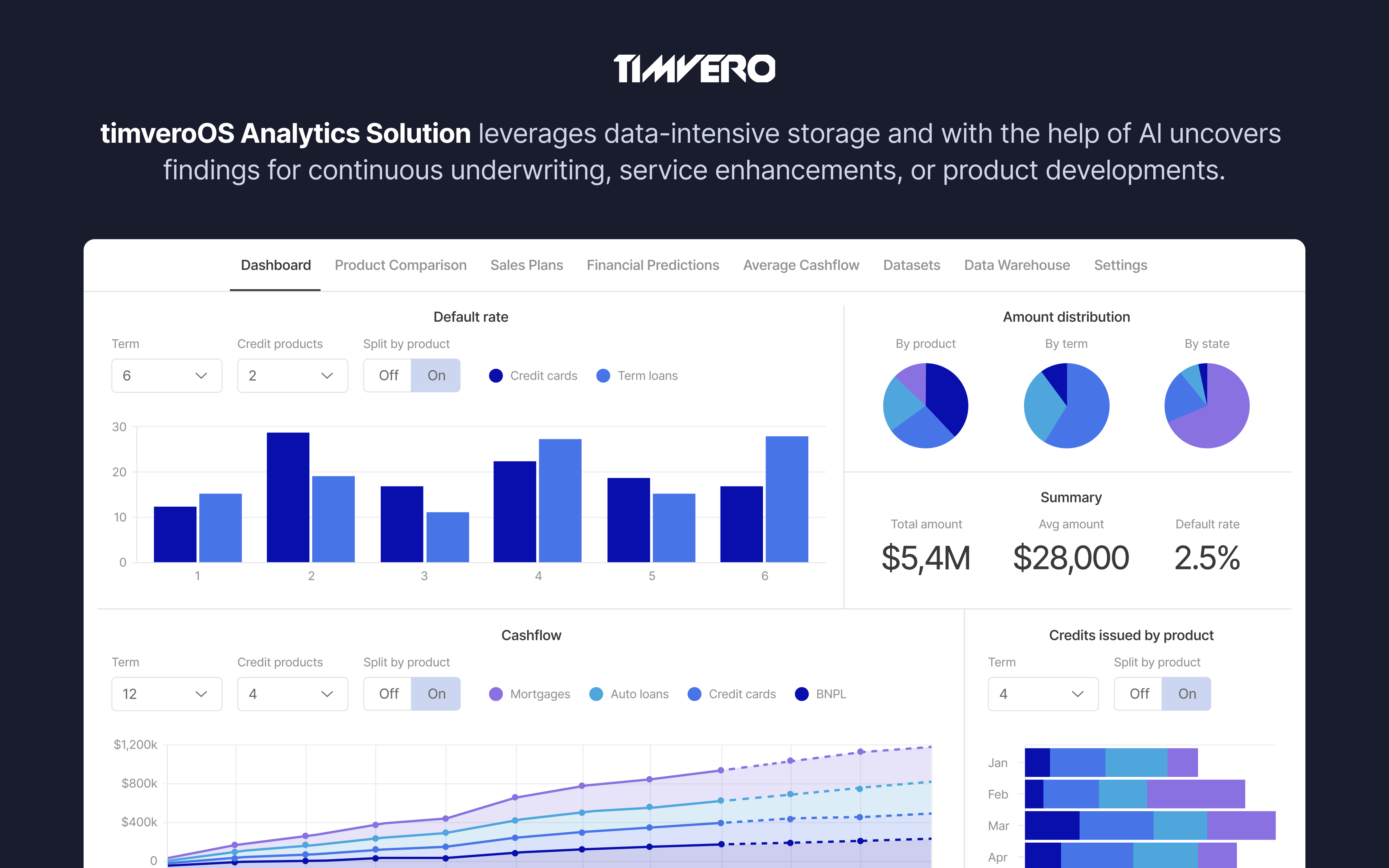

timveroOS, a forward-thinking lending software, offers scalability and data-driven origination solutions for lenders. It simplifies loan applications, boosts borrower experience, and raises conversion rates, thus ensuring customer loyalty. Our customizable software with SDK satisfies diverse lending requirements like commercial and consumer loans. The OS not only accelerates executive decision-making by 12 times through data-driven insights but also increases loan profits by an average of 20%.

Who Uses timveroOS?

US, EU, UK, Canada, Israel, LATAM.

Where can timveroOS be deployed?

About the vendor

- TIMVERO

timveroOS support

- Phone Support

- 24/7 (Live rep)

- Chat

Languages

English, German, Spanish

timveroOS pricing

Starting Price:

- No free version

timveroOS does not have a free version.

Pricing plansAbout the vendor

- TIMVERO

timveroOS support

- Phone Support

- 24/7 (Live rep)

- Chat

Languages

English, German, Spanish

timveroOS videos and images

Features of timveroOS

Reviews of timveroOS

Average score

Reviews by company size (employees)

- <50

- 51-200

- 201-1,000

- >1,001

Find reviews by score

Easy to implement all-in-one lending operating system

Pros:

It is easy to set up and launch new products without writing a single line of code.

Cons:

The documentation can be a bit more detailed.

Best in class software

Comments: Exceptional, very supportive and professionals

Pros:

The ease of use, easy integration with third party systems, supplier management, high quality analytics, best in class risk management and collections.

Cons:

Maybe some upgrades from the out of the box customer UI experience.

TIMVERO Response

2 years ago

Improved UI with brand new design

The company you would like to work with

Pros:

When it comes to timvero's approach, it is truly unique and sets them apart from other businesses in the industry. They take a comprehensive look at each client's individual needs and work with them to create a customized solution that is tailored to their specific business. This tailored approach is a key factor in timvero's success, as it allows them to stay ahead of the curve and remain acutely aware of market trends.

Cons:

While working with the team, none of the cons have been found, timvero is willing to fix any comment and does their best to do the utmost

Unparalleled Platform

Pros:

A Winning Collaboration - TIMVERO and Our Lending BusinessOur partnership with TIMVERO has been instrumental in elevating our lending business to new heights. The timveroOS platform has not only streamlined our processes but also significantly improved customer satisfaction. The support and dedication of the TIMVERO team have made our collaboration a resounding success. We wholeheartedly recommend TIMVERO and timveroOS to any organization seeking to revolutionize its lending operations

Cons:

From usage to date, we have not found any areas of improvement