17 years helping Canadian businesses

choose better software

ABLE Platform

What Is ABLE Platform?

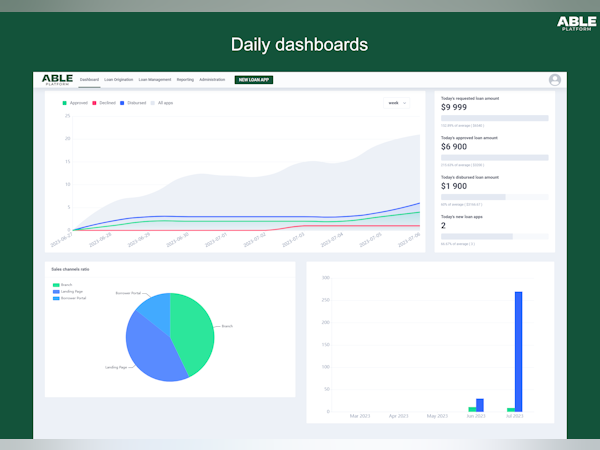

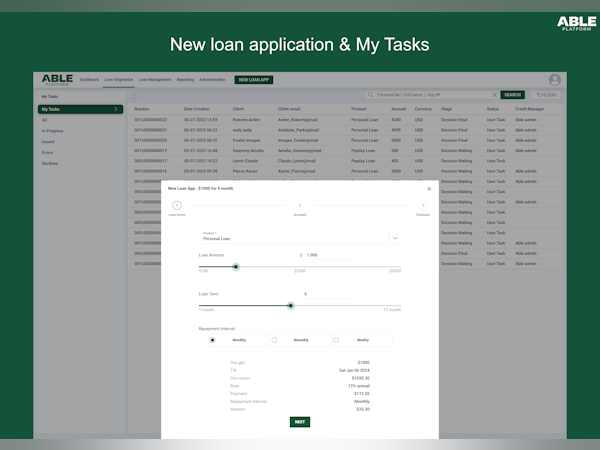

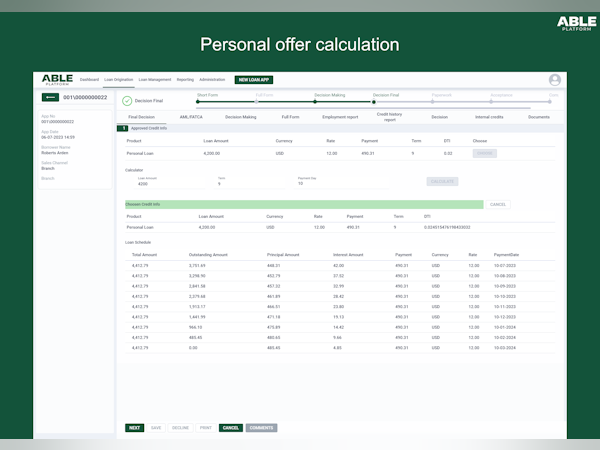

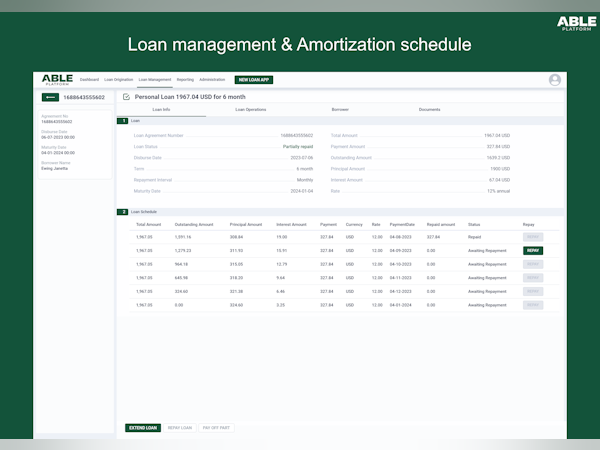

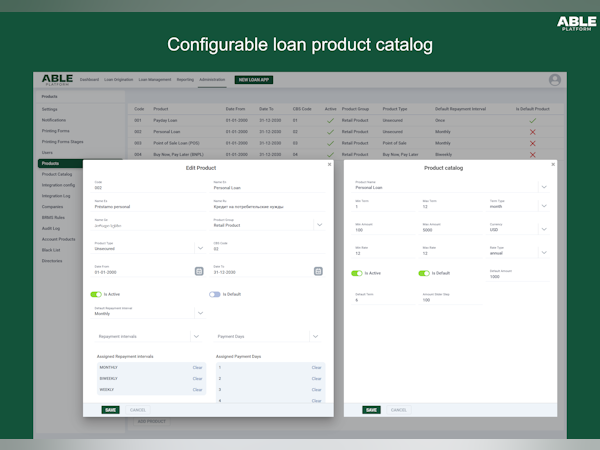

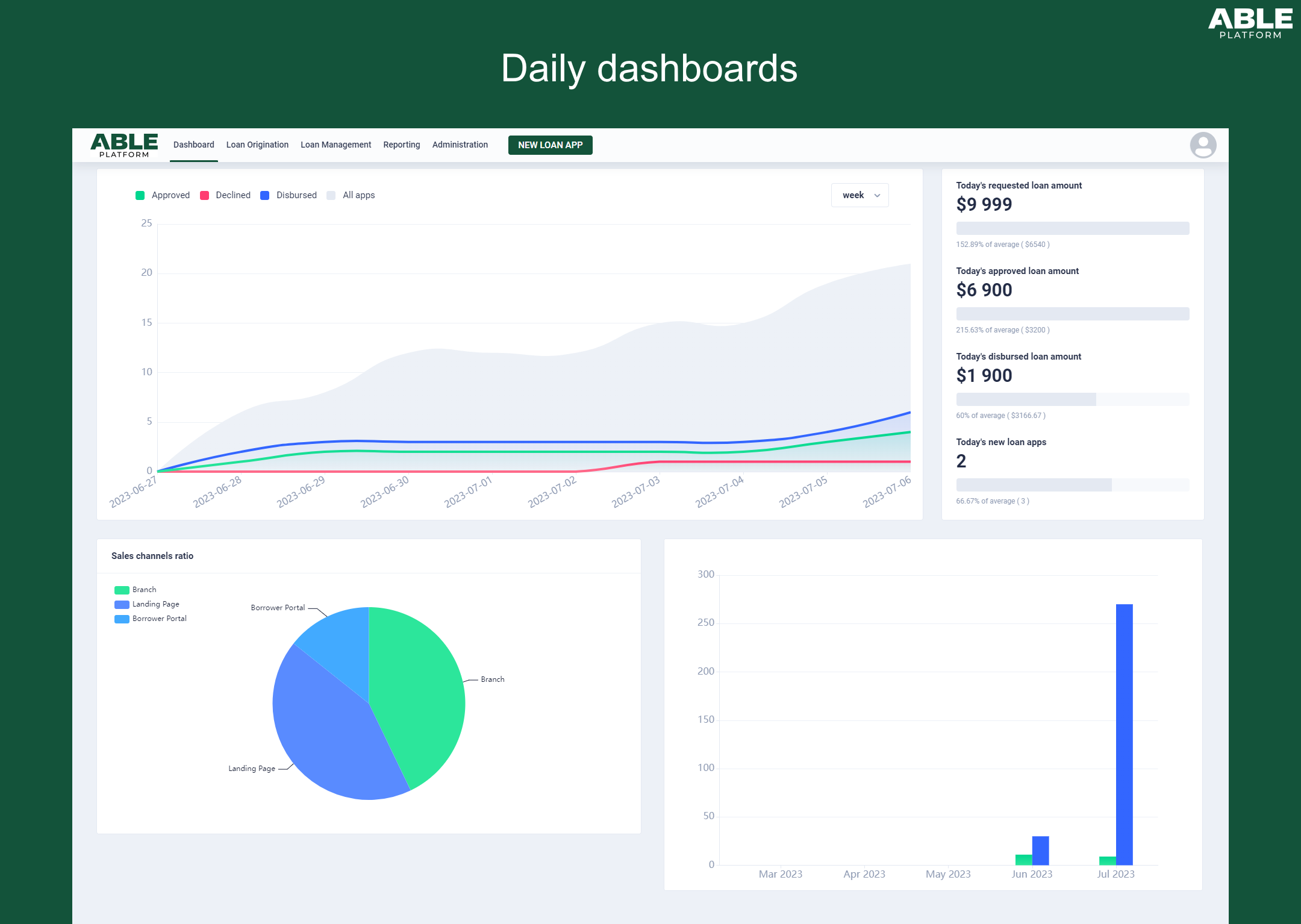

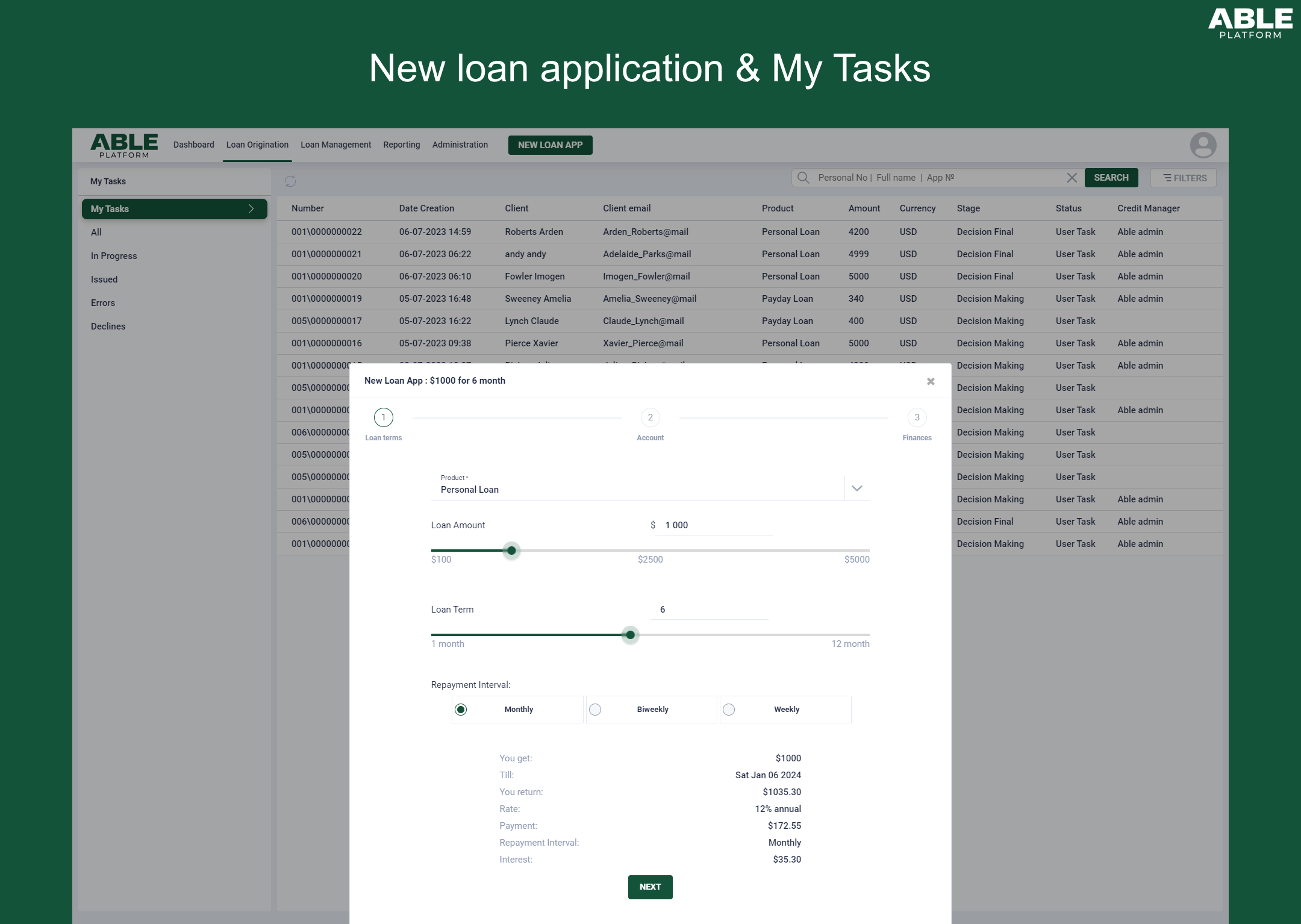

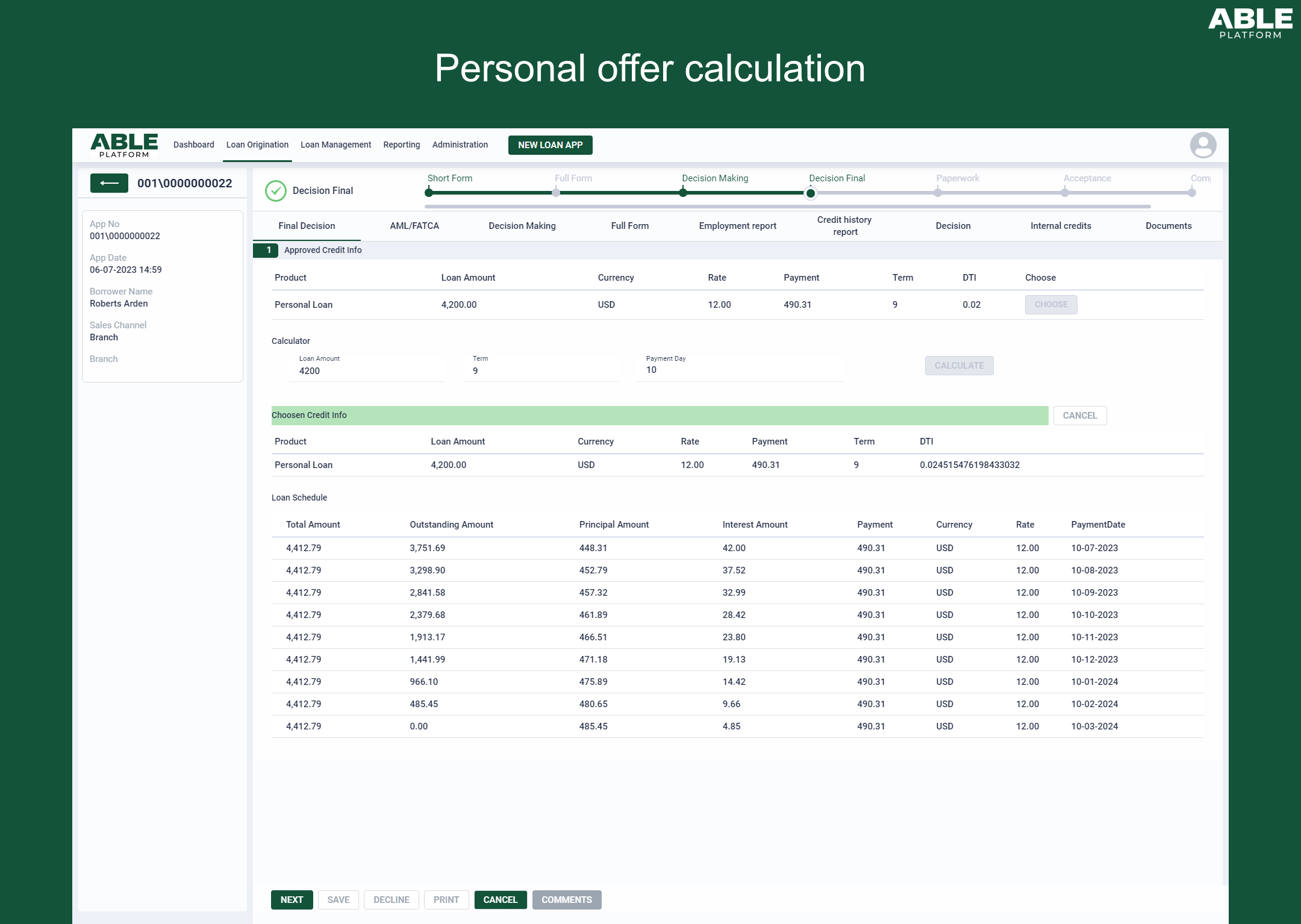

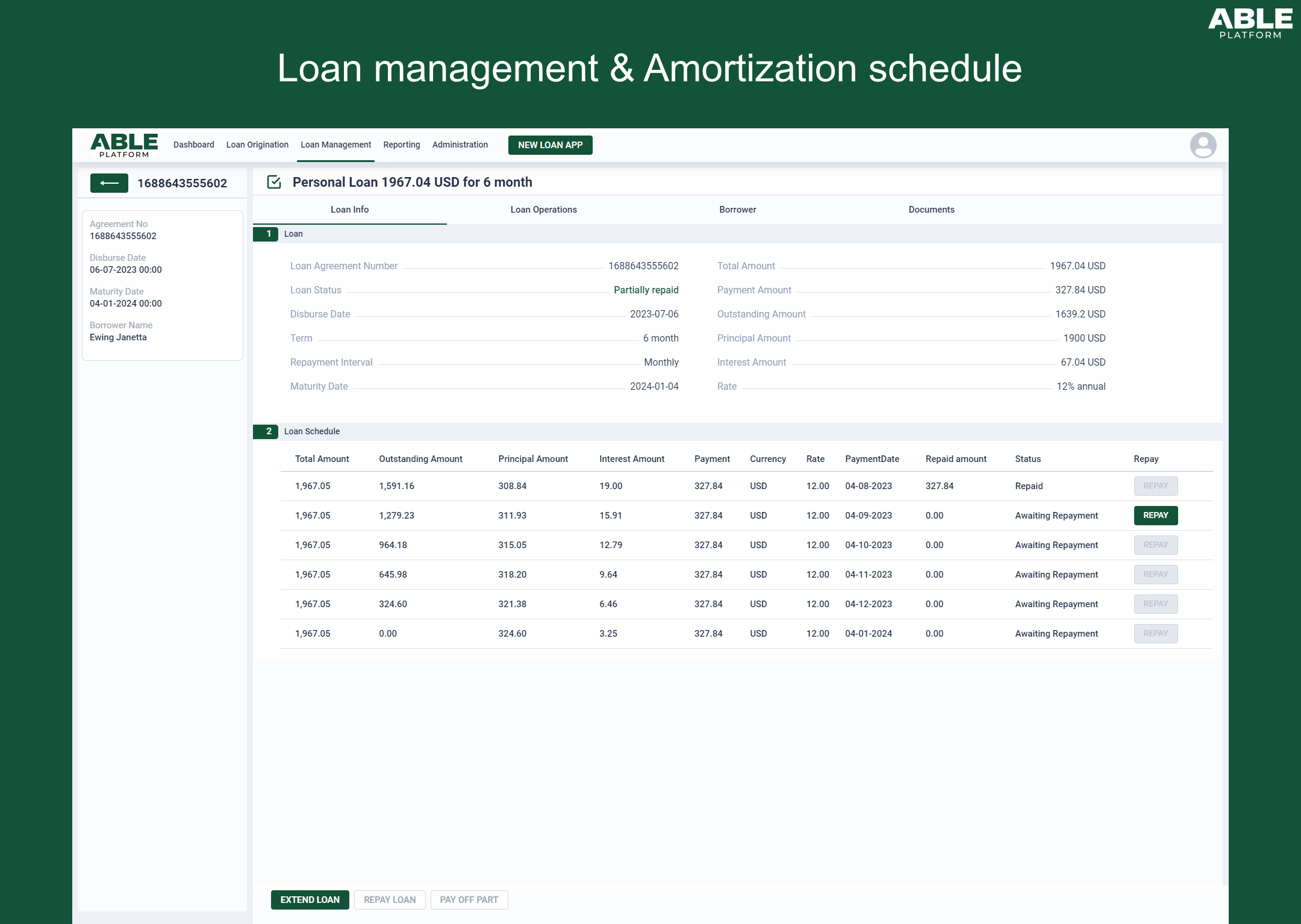

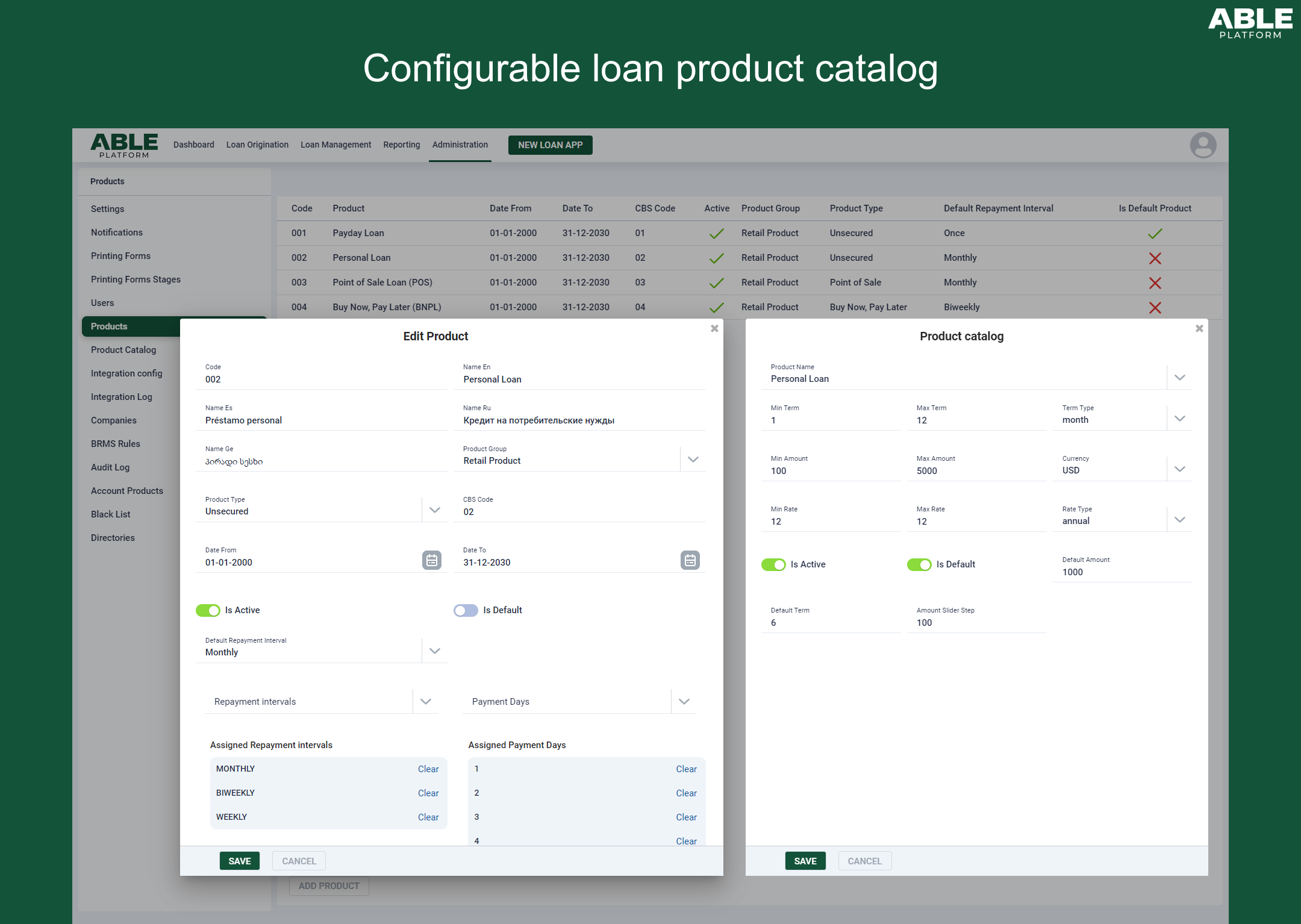

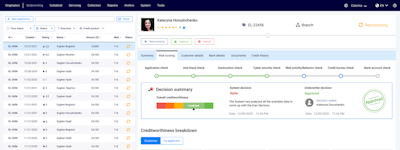

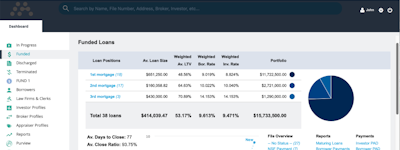

ABLE Platform is a multi-module lending web-software that covers the entire loan origination and loan management processes. The following modules are included: Landing page & Borrower portal - to attract and serve borrowers; Self-service portal - to manage the whole enterprise activity; Backoffice - the core of the platform: manage incoming loan applications, service disbursed loans, configure the loan product catalog, built-in dashboards and more. The platform can be used as SaaS or On-Premise.

Who Uses ABLE Platform?

Designed for financial institutions worldwide: banks, microfinance institutions, fintechs, retail and alternative lenders, auto-dealers, mortgage lenders and more.

Not sure about ABLE Platform?

Compare with a popular alternative

ABLE Platform

Reviews of ABLE Platform

Average score

Reviews by company size (employees)

- <50

- 51-200

- 201-1,000

- >1,001

Find reviews by score

Alternatives Considered:

Flexible and modular loan origination software

Comments: Very mature solution for loan origination and servicing that has reach features and a powerful decision engine.

Pros:

Fast deployment within 3 months. A lot of features are available out-of-the-box. Automates the entire loan origination process front-to-back. Gave about 558% improvement in productivity. Availability of multichannel interaction with customers like chatbots, messengers, etc.

Cons:

Offer matrix calculation is a bit sophisticated.

4IRE Group Response

3 years ago

Hi Paul, Thank you for your feedback! We're really glad you enjoyed ABLE Origination. We really appreciate the time you took to write such a review. This means a lot to us and lets us know we're on the right track.