17 years helping Canadian businesses

choose better software

Cyberbank

What Is Cyberbank?

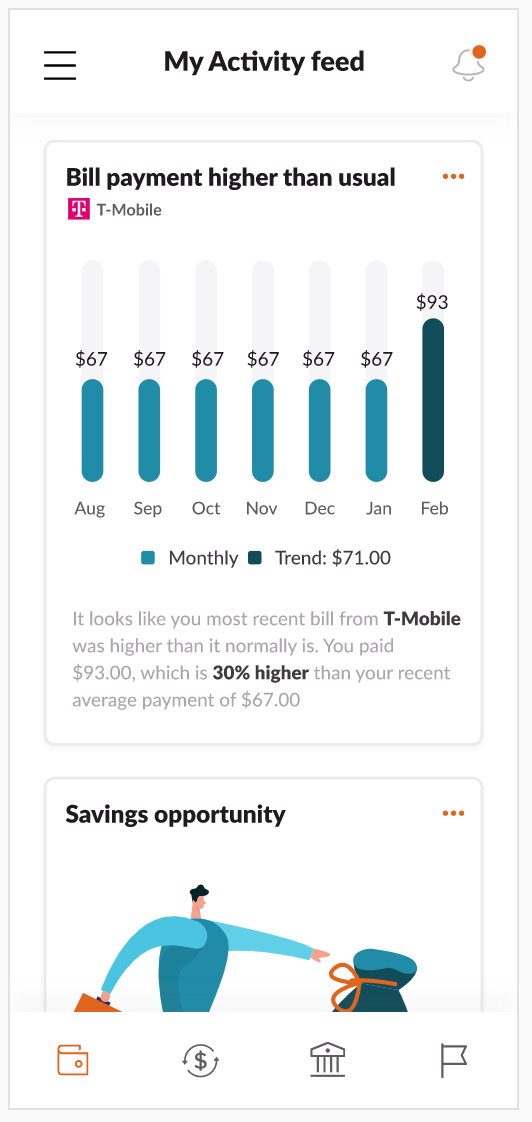

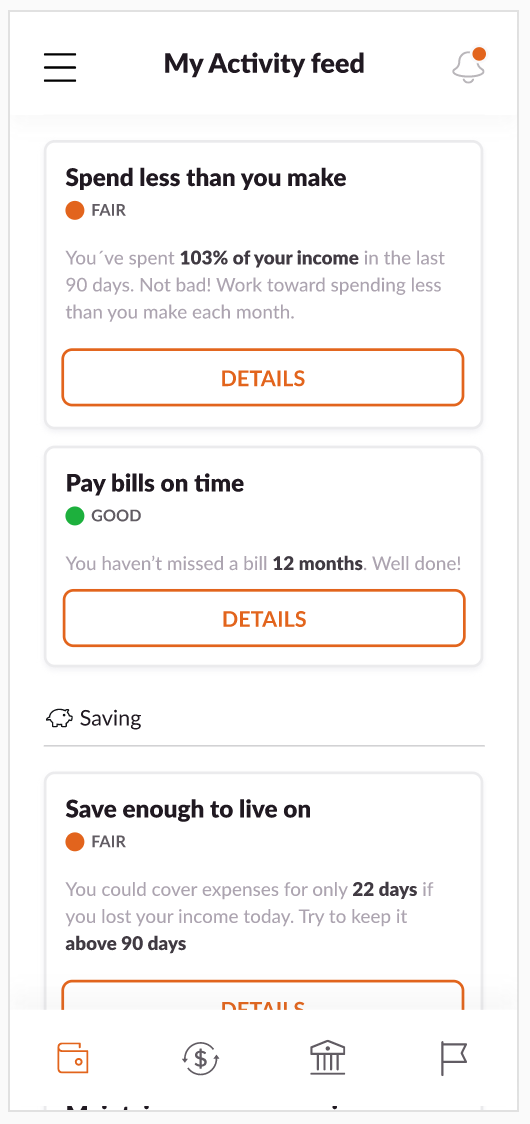

Cyberbank is the next-gen digital and core banking platform from Technisys (now Galileo Financial Technologies) designed to help mid-tier banks, neobanks and challenger banks deliver delightful digital banking experiences for customers. Dynamically create tailored financial products at the speed of commerce, deliver meaningful recommendations to customers at point-of-need, create new digital ecosystems with third parties, and scale your digital banking services securely and at speed.

After Galileo's acquisition of Technisys, the two now deliver a fully integrated API-centric financial technology platform that reinvents how people connect with their money. Both Technisys and Galileo are owned and operated by SoFi Technologies (NASDAQ: SOFI)

Who Uses Cyberbank?

Tier 2/3 banks, neobanks, challenger banks, fintechs, community banks, credit unions, brands and enterprises.

Not sure about Cyberbank?

Compare with a popular alternative

Cyberbank

Reviews of Cyberbank

Average score

Reviews by company size (employees)

- <50

- 51-200

- 201-1,000

- >1,001

Find reviews by score

Cyberbank

Comments: "It has been an incredible accomplice to work with through association's computerized change. The stage is adaptable and permits the association to tweak depending on the situation. We love hearing the appropriate response "We can do that!" on any improvement we proposed. The cycle took longer than anticipated as a result of the need to characterize all the business necessities and the need to fabricate the foundation on association's side however we really felt like we had a collaborate with it and have had the option to assemble an item that will give the client experience needs."

Pros:

Extraordinary accomplice. They got what we were planning to fabricate and executed against that without wasting much time. In particular, we as a whole settled on degree and spending plan. The Technisys Team has been incredible and functions admirably with our group!"

Cons:

The need to characterize the vast majority of the screens and usefulness. It is extraordinary to have adaptability however when as a bank we have consistently been given an item as opposed to building one it was troublesome now and again to ensure we caught every one of the necessities, guidelines, and so on