17 years helping Canadian businesses

choose better software

TaxCalc

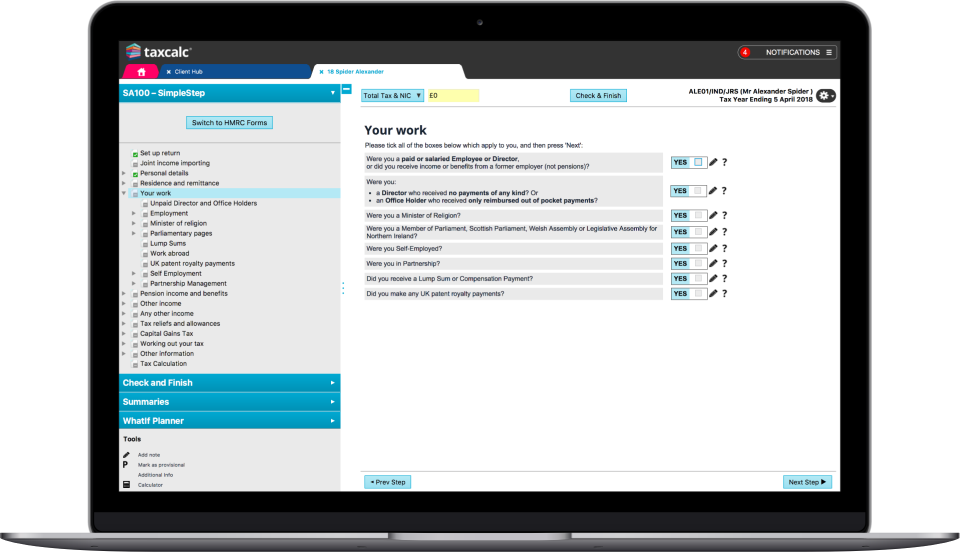

What Is TaxCalc?

The complete tax and accountancy practice software suite, powered by a single database. Trusted by over 11,000 of firms of all sizes.

Award-winning and officially-recognised by HMRC, its incredibly simple to use and comes with smart tools to power through your work quickly and accurately.

Who Uses TaxCalc?

Accountancy Practices Tax payers required to file Self Assessment returns

Not sure about TaxCalc?

Compare with a popular alternative

TaxCalc

Reviews of TaxCalc

Good Practice Software

Comments: The software has become a central hub to our business and has proven reliable and good value

Pros:

This software was easy to implement and has proven flexible and user friendly. The whole team enjoy using it.

Cons:

Not much that we do not like! The integration with document signing could be improved but we deal with it using a third party package

Intuitive and powerful

Comments: I love this software and fully trust its tax calculations.

Pros:

It is highly intuitive and powerful software. Updated and available early enough in the tax return submission cycle. Ensure compliance and prompts in a user friendly way where tax efficiencies and savings can be obtained.

Cons:

That it requires a software installation limits what computers you can use this on. I have multiple devices with differing software install restrictions. So, we have to dedicate one device for this purpose.

Tax Calc is really good

Comments: I love using Tax calc. I use it everyday for work and as an accountant, it is one of the best softwares i have used for accounts production and tax returns. Would highly recommend.

Pros:

Tax calc is easy to use and really simple to be able to navigate your way around the system.

Cons:

Sometimes it freezes. But it is nothing major, is still a good software to have.

Best Tax software

Comments: I've been using this for the pass 15 years and honestly this is the best

Pros:

Easy to use and understand and the managers are also there to assist

Cons:

They should do Accounting packages or uploads to and from

Corporation Tax - simply

Pros:

That it imports the company accounts for you.

Cons:

That sometimes when you are given an error code you are not told what that error code means.

Straight forward, value for money and simple to use

Comments: When we started the practice we used Companies House and HMRC's free products but TaxCalc is far superior to that and looks more professional when seding documents to clients. As well as both the accounts and calculations being in one place.

Pros:

Intergration with Quickbooks for importing trial balances for completing company accounts.

Cons:

Lack of intergration with practice software such as Accountancy Manager. This means duplication of client entry.

TaxCalc user

Pros:

It is very easy to use, being menu driven makes it easy to find what you need. The full integration of services is also really handy when setting up clients and making sure all relevant info is pulled through.

Cons:

It would be great if it supported management account preparation.